views

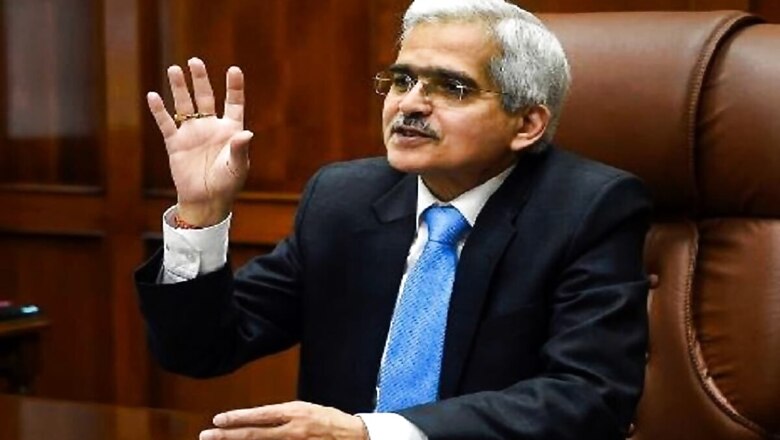

The Reserve Bank of India kept the repo rate unchanged at 4 percent — the rate at which it lends money to commercial banks. The reverse repo rate was also kept unchanged at 3.35 percent.

The Central Bank also maintained an accommodative stance. Here is what these banking terms mean and why they were largely unchanged.

Also read: In 1st MPC Meet Post Budget, RBI Leaves Repo Rate Unchanged at 4%, Says 2021 Setting Up for New Growth Era

What is repo rate and what does its change indicate?

The repo rate is the rate at which the central bank of the country will lend funds to the commercial banks. The commercial banks borrow funds only if they witness a shortfall in their funds.

The lending rate, plus the loan amount, will have to be returned to the central bank. In theory and practice, the repo rate is used as a tool to tackle inflation and garner growth. If the monetary policy committee of a country orders a cut in the repo rate, this means that the authorities are opening the gateway for growth at the cost of inflation.

For instance, if the repo rate is cut to 3.75% from the present 4%, the repo rate indicates more borrowing of funds by the commercial banks.

If the commercial banks pay lesser to the central bank, the commercial banks will also be willing to pass on the benefits to the consumers. When the consumer or even a company gets enough funds, he or she can also invest in land, market and so on. If there’s investment in the economy, it will result in growth. Since the economy is loosening up to borrowing with a repo rate cut, the market welcomes the move. The market turns bullish in trade, whenever there is a cut in the policy rate.

Consequently, if the repo rate is increased, the economy is letting go of potential growth in order to tackle the rising inflation in the economy.

Inflation is the increase in prices and fall in the purchasing value of money.

For instance, if the repo rate is increased to 4.25% from the present 4%, it will indicate lesser borrowing and more saving of funds.

If the commercial banks are expected to return a higher loan amount to the central bank, they will not be able to pass on the benefits to the consumers. The consumers will also, instead, save more instead of heading to the lenders for a loan. The increase in the repo rate hurts the investor sentiment and the investors begin to trade cautiously in the market.

No change in repo rate signifies a period of caution where the Central Bank wants market forces to act and wait before making the next move. Also, the Central Banks is of the opinion that there is no current need for liquidity or battling inflation in the markets.

Also read: RBI to Restore Cash Reserve Ratio in Two Phases to 4 Pc

What is the reverse repo rate?

The monetary policy committee of a country uses the reverse repo rate as a tool to control the money supply in the country.

By definition, the reverse repo rate is the rate at which the central bank borrows money from the commercial banks.

The increase in the rate indicates a fall in the money supply and a cut in the rate indicates a rise in the money supply. An increase in the rate means that commercial banks will be incentivised to park their funds with the central bank, which can help in reducing the money supply in the economy and vice-versa.

When the money supply increases, it could lead to a rise in the prices leading to inflation. The reverse repo rate is the tool used when the cause of the inflation is the increase in the money supply.

Read all the Latest News, Breaking News and Coronavirus News here

Comments

0 comment