views

Cashing a Check at Your Bank

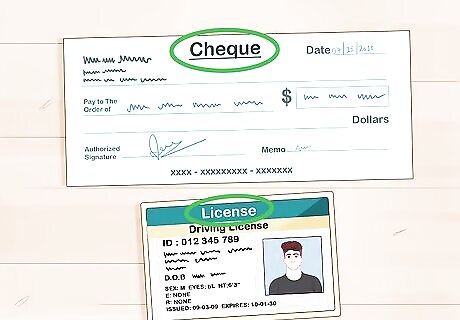

Bring a valid photo I.D. to any branch of your bank. If you hold an open account of any type with a bank, they will cash a valid check for you. However, when you cash a check in person, you may be required to show a valid photo I.D. Driver’s licenses and passports are usually the best choices. In some cases, military or school I.D.s may be accepted. Many banks prefer that you have your bank debit card with you as well. If you do not have your debit card, you may be required to fill in additional forms to cash your check. Contact the bank branch with any questions about their I.D. requirements. You won’t be required to show a photo I.D. if you cash the check at an ATM or via your smartphone.

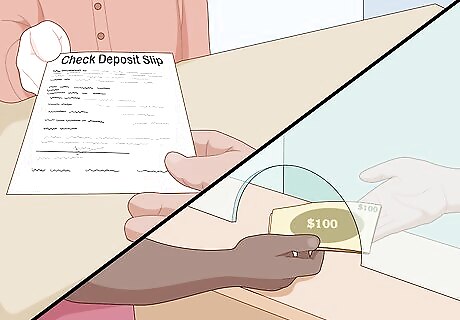

Cash your check with your bank teller. This is the easiest method for getting the money you have earned quickly and safely. Show the teller your I.D. or hand them your debit card, if requested. Never sign the back of the check before you arrive at the bank; instead, do it in front of the teller as you cash it for ultimate security.

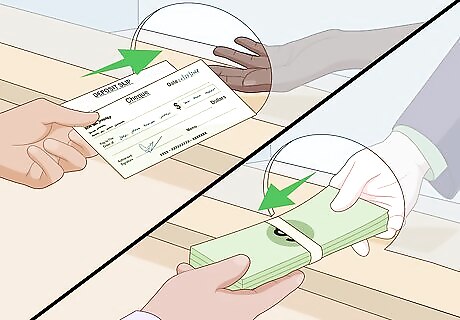

Deposit the check, then withdraw cash from your account, if necessary. Some banks may require you to deposit the check to your account rather than cash it. This is more likely if the check you are trying to cash is written on an account from another bank. If you need cash right away and already have sufficient funds in your bank account, you can deposit the check, then immediately make a withdrawal in the amount you need. If the bank on which the check is drawn refuses to pay your bank — in other words, the check “bounces” — your bank will reimburse itself from your bank account. Banks will also usually charge a fee for the trouble of dealing with a returned check.

Deposit your check at one of your bank’s ATMs. Modern ATMs (Automated Teller Machines) make it easy to insert and deposit paper checks to your account. Depending on your bank, the funds may be available immediately, or you may need to wait up to three days for the cash to go through. But, if you already have sufficient funds in your account, you can just withdraw the amount you need in the meantime. Insert your debit card Type in your PIN and press Enter Select "Deposit Check" Insert the check into the check deposit slot Confirm the amount on the check Withdraw the money you need from the ATM.

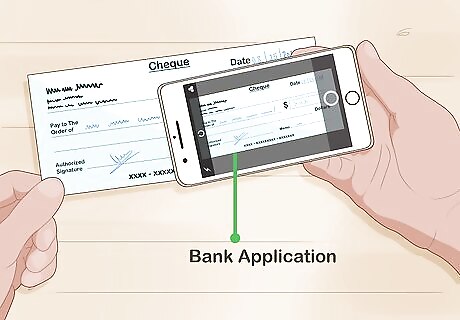

Use a mobile banking app to deposit the check. Many banks now allow you to deposit checks into your account using a smartphone. The process may vary between banks, but it usually involves downloading the bank’s app and using your smartphone camera to take a photo of your check. Make sure to follow all the directions in the app. Endorse the check, then take clear, well-lit photographs of its front and back sides. Keep the check until you receive confirmation that it has been deposited, then destroy it. Once the check clears, though, you will have to leave the house to withdraw the money you deposited from an ATM or bank branch. You should keep a check that you deposit through a mobile app until you can confirm it's in your account.

Cashing with Other Banks, Businesses, or People

Visit the bank that issued the check. You can find the name of the bank by looking at the front of the check. Most banks will (and may be legally required to) cash checks that are drawn on sufficiently-funded accounts at their bank. The bank may, however, charge you a fee if you're not an account holder with them. You must cash the check in person with a bank teller (not at the ATM) if you are not an account holder there. You may need to show a valid photo I.D., so bring one along. If the account the check is written on does not have sufficient funds to cover the check, the bank is not required to cash it. Some states in the U.S. have laws that require banks to cash checks drawn on their accounts without charging a fee.

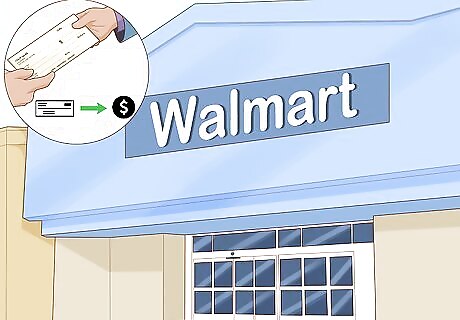

Cash your check at a major retailer. Large grocery store chains and general merchandise retailers (like Walmart) often let you cash business or payroll checks for minimal fees — some, but not all, may also cash personal checks. This can cost less that doing the same thing at a bank you don't hold an account with, or at a cash-checking service. Just like when you take a check to a bank, don't sign the back of your check until you are in front of the person who is cashing it for you. Some retailers may require you to be a member of their rewards or loyalty program, but these are nearly always free and easy to join.

Deposit and withdraw funds at ATMs with a prepaid debit card. Many financial institutions now offer prepaid debit cards to people without bank accounts. If you have a prepaid card, you will usually be able to deposit checks at select ATMs. You may be charged a fee to deposit and withdraw funds, depending on the card. For example, Visa has a reloadable “Payroll Card” that you can get through your employer. You can deposit checks and withdraw money at any ATM that accepts Visa debit cards. Many large banks also offer prepaid debit cards. Chase offers a prepaid card that allows you to deposit checks at any Chase ATM, for a monthly fee of approximately $5 USD. Prepaid cards are usually available through large financial institutions such as MasterCard and American Express.

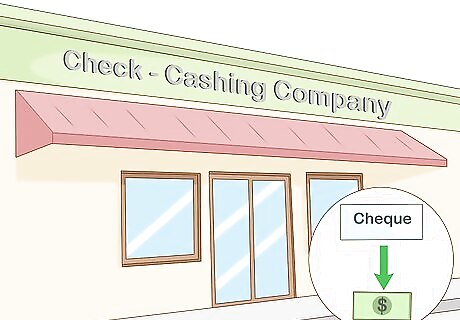

Go to a specialized check-cashing company if you lack better options. You should only use this method as a last resort simply because these firms charge the most money for cashing personal and payroll checks. On the upside, these stores are often the quickest way to get most of your cash immediately. However, the commission that these check-cashing places take is hefty — often more than 10% — due to the extra risk they take by cashing nearly all checks brought to them. These places know that they are working with customers who need the money from the check ASAP, and therefore can charge them high fees. If you do not have a bank account and need cash immediately from a personal check, check-cashing services may be your only option.

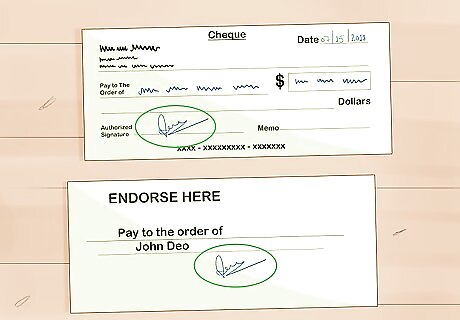

Sign the check over to someone you trust. By signing the back of your check over to someone you trust and know well, they can just as easily go into their own bank, cash it, and hand you the money. Of course, the stipulation here is that you should only ask someone you truly trust to do this for you. In most cases, you should probably accompany them to the bank when they are cashing your check, though it is not necessary for you to be present. To endorse the check to another person, write “Pay to the order of _______” on the reverse side of the check. Sign your name below this. In some cases, you may also be required to initial near the written and numerical amounts on the front of the check. Never ask someone you do not know very well to cash a check for you. Never cash a check for someone you do not know and trust extremely well.

Taking Sensible Check-Cashing Precautions

Make sure you trust the person who wrote you the check. If you end up with a bad check, you'll have a lot more trouble trying to retrieve the money that is rightfully yours. If you're asking for payment from someone you've never met before, it's better to ask for the amount of money in cash. But if you do have a check, make sure you have the following information: The correct first and last name and address of the person giving you the check. Contact information for the person who wrote you the check, so you can reach them if you have trouble cashing it. The name of a legitimate bank where the check is being drawn from. Check with the issuing bank to confirm that the person writing the check has an account with funds available to cover it. Many banks will verify the account the check is drawn from if you contact them.

Make sure the check is properly written out to you. It is very important for your name to be written correctly on the check. Banks can deny payment if the name does not match that of the person attempting to cash it. Ask for the name on the check to be written to match the name on your valid photo I.D. (driver’s license, etc.)

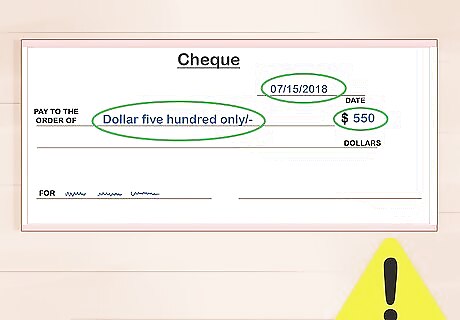

Look for any check endorsement problems. All of the information on the check needs to be complete and accurate. This includes the date, amount of payment, and signature. If the information is invalid or missing, you probably won’t be able to cash it. The date written on the check is the first date on which the funds may be withdrawn. The numerical amount box is located below the date. It represents the exact amount to be paid. Make certain that this is the correct amount you are owed and that it matches the written dollar amount located to the left of the box. For the check to be valid, it must contain the signature of the owner of the account from which the funds will be withdrawn. Erin Lowry Erin Lowry, Personal Finance Expert Before cashing any check, pause to inspect both sides for signs of fraud — uneven edges, smudged ink, mismatched fonts. Then, verify with the payer that the details match what they authorized. Though cashing checks can bring quick funds when needed, additional fees and lack of recourse for fakes expose you to loss. Consider safer options like linking accounts for electronic transfers, especially with new payees.

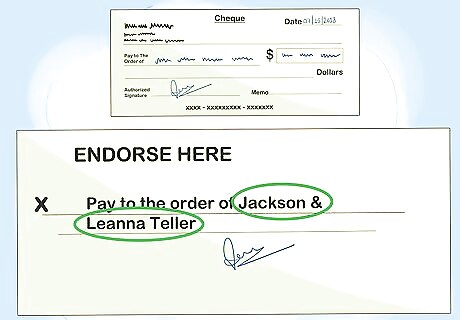

Endorse the check right before you're ready to cash it. To endorse the check, you just have to flip it over and sign the line with the "x" to the left of it. Do this right before you go to the ATM or the bank, so that your check cannot be cashed as easily if you lose it. If there is more than one payee — e.g., “Pay to the order of Jackson and Leanna Teller” — all payees must endorse the check in order to cash it. However, a check can be deposited into a joint account with only one of the joint owners signing it. Once the check is endorsed, unless there are written restrictions, the check becomes a "bearer" instrument that anyone (in theory) can cash.

Cash the check as soon as you can. Some checks, like those that are paid by employers, have an expiration date on them. But even if they do not have an expiration date, banks are often not legally required to accept checks 6 months after their written date. So, you should cash them in a timely manner to make sure that you can get the money you deserve as quickly and easily as possible.

Comments

0 comment