views

In a historic achievement, Nvidia has surged to become the world’s most valuable company, boasting a market capitalization of $3.34 trillion. This remarkable feat comes amid blockbuster earnings and growing investor enthusiasm over artificial intelligence (AI). Nvidia is now the 12th US company since 1925 to claim the top spot in market value. Here’s a detailed look at how Nvidia reached this unprecedented milestone.

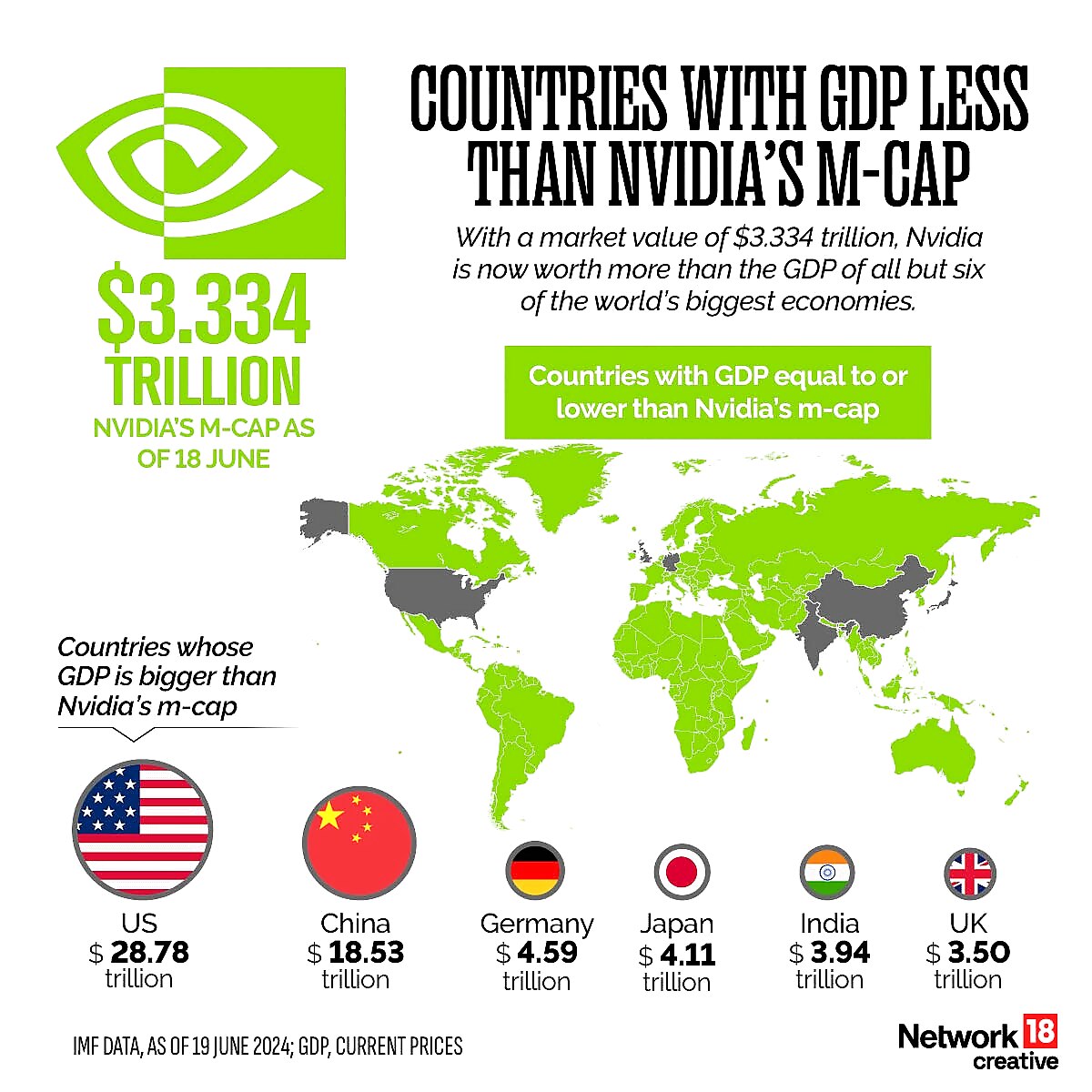

With a market value of $3.334 trillion, Nvidia is now worth more than the GDP of all but six of the world’s biggest economies. Only the US, China, Germany, Japan, India and the UK are ahead of Nvidia.

Technological Innovation

Nvidia’s meteoric rise can be attributed primarily to its groundbreaking advancements in graphics processing units (GPUs). Initially renowned for revolutionizing the gaming industry, Nvidia’s GPUs have now become indispensable in various high-growth sectors, particularly artificial intelligence (AI).

Nvidia’s chips are unmatched in producing processors that power AI systems, including generative AI—the technology backing OpenAI’s ChatGPT, which can create text, images, and other media.

Founded in 1993 by Jensen Huang, Chris Malachowsky, and Curtis Priem in Santa Clara, California, Nvidia launched its first graphics processor, the NV1, in 1995.

From 1999 to 2005, Nvidia dominated the gaming graphics market with its GeForce series, including the GeForce 256, the first GPU with an integrated transform and lighting (T&L) engine. This era also saw Nvidia acquire 3dfx, a major competitor in the graphics card market.

Between 2006 and 2012, Nvidia diversified its offerings, launching the Compute Unified Device Architecture (CUDA) for GPU-based parallel computing and the Tesla GPU for high-performance computing. A significant breakthrough came in 2009 with the release of the first Tegra processor, marking Nvidia’s entry into the mobile market.

From 2013 to 2018, Nvidia shifted focus towards AI and data centres, introducing the Nvidia GRID for GPU virtualization and the Nvidia Drive platform for autonomous vehicles, in partnership with Tesla.

Since 2019, Nvidia has aggressively pursued AI and the metaverse while expanding its data centres. The introduction of the Nvidia A100 Tensor Core GPU and surpassing a $1 trillion market capitalization in 2023 solidified its industry leadership. In 2023, Nvidia’s data centre revenue surged by 35 per cent, accounting for nearly 40 per cent of the company’s total revenue.

Strategic Acquisitions and Partnerships

Strategic acquisitions have played a crucial role in Nvidia’s ascent. The acquisition of Arm Holdings in 2022 for $40 billion was a game-changer. Arm’s extensive portfolio of chip designs, widely used in mobile devices and increasingly in IoT and edge computing, provided Nvidia with a massive competitive edge.

Moreover, partnerships with leading companies across various industries have bolstered Nvidia’s market position. Collaborations with tech giants like Google, Microsoft, and Amazon have ensured that Nvidia’s technology remains at the cutting edge of innovation.

Nvidia’s Financial Might and Market Performance

Nvidia’s financial performance has been nothing short of spectacular. As of June 19, 2024, Nvidia’s market capitalization stood at $3.34 trillion, overtaking Apple, Microsoft, and Saudi Aramco.

Nvidia’s stock has skyrocketed, delivering a return of over 400 per cent to shareholders over the past three years. The company’s shares have risen more than 170 per cent this year and about 1,100 per cent since their October 2022 low.

For now, Nvidia’s earnings are supporting its stock price. Revenue more than tripled to $26 billion in the latest quarter, while net income jumped seven-fold to $14.9 billion.

Blockbuster earnings and broadening investor enthusiasm over AI are supercharging Nvidia’s rally. This fervor is reflected in Nvidia’s market value, which took only 96 days to rise from $2 trillion to $3 trillion. In comparison, Microsoft took 945 days and Apple took 1,044 days to make the same leap, according to Bespoke Investment Group.

Nvidia’s impressive financial performance and forecasts have moderated its stock valuation despite the surge in its share price. Nvidia’s forward price-to-earnings ratio recently stood at 43, according to LSEG Datastream, higher than the 25 level at the start of the year but below last year’s levels. By contrast, the S&P 500 trades at 21 times earnings.

Comments

0 comment