views

There are a number of investment options that can help you save taxes; however, the equity-linked saving scheme (ELSS) option not only helps you save tax but build wealth through disciplined investing.

Who wouldn’t love to save tax? After all parting with our hard earned money in the form of tax is such a pain. But there are avenues using which one can save tax and a popular one among them is Section 80C. Financial prudence demands that we minimize our tax out-go as much as possible. After all, a rupee saved (tax) is a rupee earned right?

But is tax saving an end in itself? Can this endeavour achieve more for you? Yes, by combining wise investing with the tax-saving activity, you can also build wealth for the future. By inculcating the discipline of investing for tax saving, you ensure that you put away a part of our income for future needs. But it is also important that this money does not lose its value due to the evil of inflation. The investment should beat inflation (on a post tax basis) to be of any significant use to you in the future.

Getting to know Section 80C better

Let’s get back to basics and see what Section 80C is all about. As is generally perceived, Section 80C is not aimed at complicating or making life difficult for taxpayers, but the government’s intention is to encourage savings and investments. This section allows you a deduction of up to Rs 150,000 on eligible investments and expenses. Where investments are concerned, you have a number of choices — ELSS, ULIP, PPF, NSC, fixed deposit, etc.

ELSS versus the rest

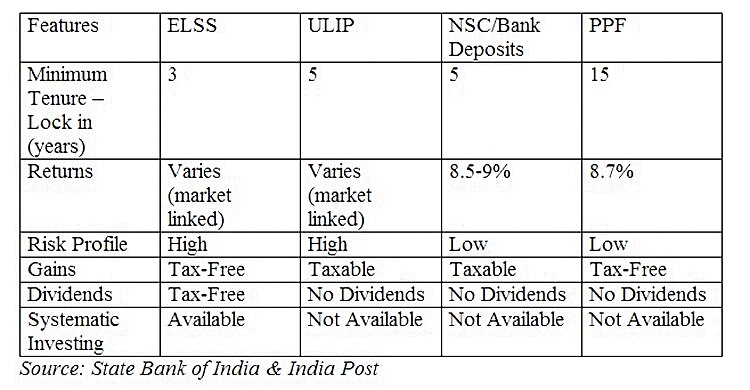

Comparison of the various avenues should be done on three important parameters —liquidity, returns and risk.

Liquidity

Liquidity or the ability to convert investments to cash is always preferred over investment having longer lock in periods, even if it is a tax-saving investment. Also, a sudden need for cash can arise for which one would need to be prepared. In order to claim the tax benefit, section 80C requires one to remain invested in the eligible investment for a specific period. Here ELSS has a huge advantage. Among all the eligible investments in section 80C, ELSS has the lowest lock in period of 3 years.

Returns

ELSS being an equity fund, provides the investor the opportunity to participate in the profits of the company whose shares are invested in. This increases the possibility of earning higher returns than from debt investments such as PPF, NSC, bank fixed deposits, etc. where the investment returns are fixed. The possibility of earning higher returns from equity investments has been validated time and again from various research and independent studies.

Risk

ELSS are equity-oriented funds that invest in shares of companies across different sectors and market capitalisation. Investing in equity, though profitable in the long term, carries a higher risk than investing in debt securities. However, by investing in equity through ELSS, your risk is reduced to some extent as you have availed the services of professional fund managers to manage your investments. Also, your investment is spread across shares of a number of companies, which further reduces your investment risk.

How does ELSS score over its peers?

Though there are many investment avenues (some even seemingly similar to ELSS) that can fetch you the tax break, ELSS scores high on many factors. Some of them are:

1) Being an equity-linked product, it has a high potential of creating wealth in the longer term as discussed earlier.

2) ELSS is more transparent. Regular disclosure of portfolios and calculation of NAVs make ELSS the most transparent option.

3) ELSS costs are lower than the comparable options.

And most importantly, they are simple and easy to understand when compared to competing products. Performance can be easily judged based on the NAV movement and dividend receipts.

Disciplined investment through ELSS

Your income is received throughout the year and not as an annual lump sum. It is therefore pertinent that your saving and investment activity too follow a similar pattern as do your expenses. Mutual funds offer the Systematic Investment Plan (SIP) facility with ELSS which allows you to deploy your savings regularly. With SIPs, you have the convenience of investing a fixed amount periodically (every week, month, etc.) in ELSS based on a one-time instruction.

This helps you save in a disciplined manner without disrupting or putting undue strain on your liquidity or other financial obligations. That is, SIP enables you to spread you tax planning burden throughout the year rather than in a month or two.

You can deploy your regular savings almost instantaneously rather than let it lie idle in your bank savings account. This way, your savings would fetch you better returns.

You are spared of the hassle of making multiple investment actions to deploy your regular savings. A one-time mandate would ensure that your investment activity continues un-hindered.

To conclude, while equity investing pays handsomely in the long run, investing in equity through ELSS provides tax benefits and helps invest in a disciplined manner using the SIP facility thereby helping you build wealth over the long term.

This is a sponsored post by Canara Robeco Mutual Fund for an investor awareness campaign.

Comments

0 comment