views

Entering the Necessary Information

Obtain a check register book. You should have received one or two of these when you ordered your checks. If not, your bank will give you one for free.

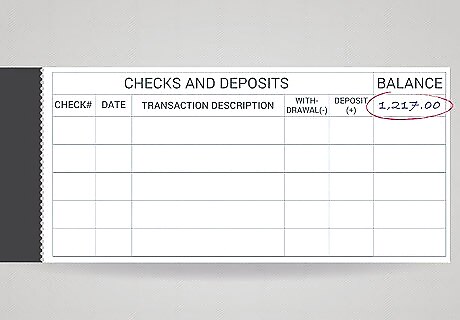

Enter the initial deposit on the first page. On many check registers, you'll find a box for this in the upper right-hand corner on the line with the column labels. This amount is your starting balance. If your register doesn't include such a box, write the words "Starting Balance" in the first line under the Description of Transaction and enter the starting balance in the box on the far right. If you've previously filled out a check register and are starting a new one, this amount is your carryover balance from the previous check register.

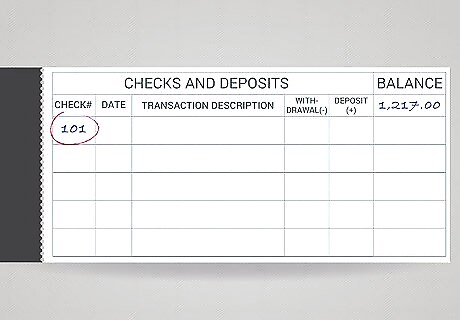

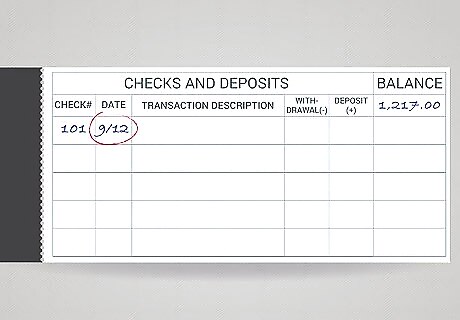

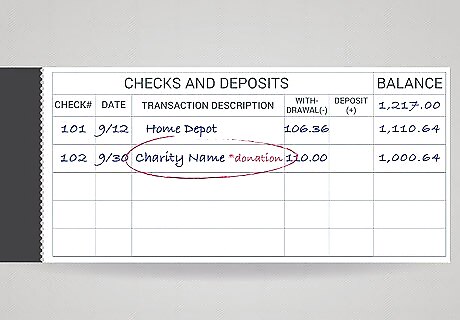

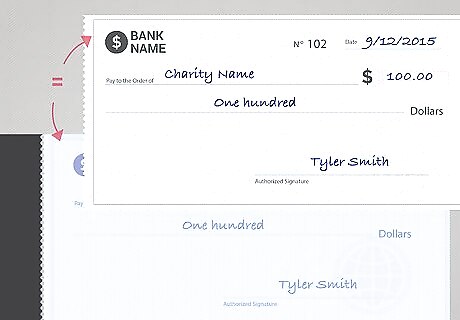

Enter the number of the check. This will be in the field on the far left. Your check number can be found in the upper right hand corner of your check. If recording a debit card purchase, you can leave the field blank, or write "DBT" in the field.

Record the transaction date in the Date field. This will be the date you wrote the check, used your debit card or made a deposit. Always record checks in your register at the time you write them.

Recording Transactions

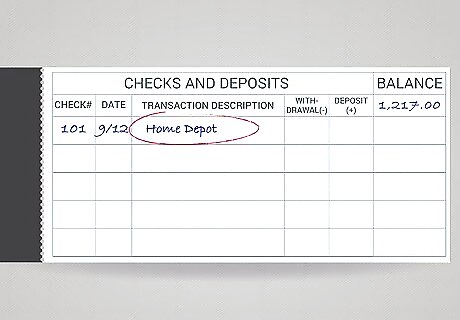

Write the details in the Description of Transaction field. For a check or debit card purchase, this is either the person or business to whom you wrote the check (the place where you spent your money), the reason recorded on the check's Memo line, or some combination of the two. For a deposit, this is the person or business who gave you the money, or, if you are receiving interest on an interest-bearing account, the word "Interest."

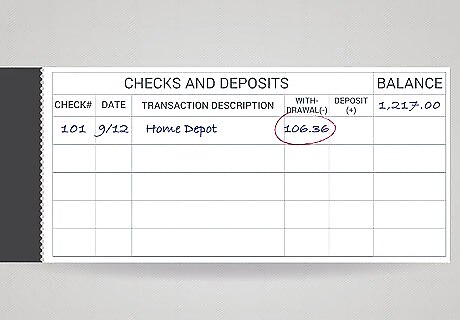

Fill in the amount. This could be from a deposit, payment or withdrawal. Most check registers provide separate columns for recording payments or withdrawals and deposits. If you are recording a debit card payment to a restaurant, don't forget to include the amount of the tip. Record the amount of your payment. This could be from writing a check, using a debit card purchase or a fee charged by your bank. Enter this in the Payment/Withdrawal column. This column is immediately to the right of the Description of Transaction field and may be followed by a narrow, unlabeled column in which you can check off the checks reported as cleared on your monthly bank statement. Record the amount of your deposit or interest payment in the Deposit column. This column is to the right of the Payment/Withdrawal and check-off columns.

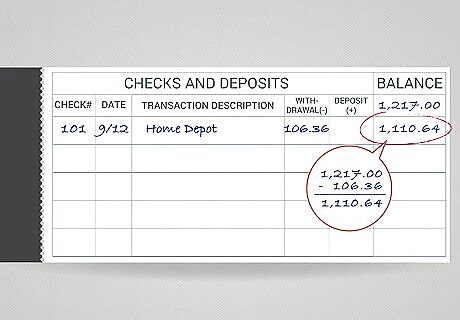

Calculate and record your new balance. Subtract the amount of any payment or withdrawal from the current balance, or add the amount of any deposit or interest payment to the current balance. Record the new balance in the space in the Balance column at the far right under the previous balance. Make sure to balance your checkbook on a regular basis so that your numbers are always accurate.

Keeping Good Records

Keep all checkbook registers for at least seven years. You will need this information if your taxes are ever audited or if you have a payment dispute with someone you wrote a check to. Keep the registers in the same file with your yearly income tax information and you will easily find it if you need it.

Write checks for charitable donations. Rather than using a credit card or cash, if you write a check for charitable donations you will have all the information you need in your check register to record these amounts on your tax returns. You can circle the entry in your register, use a highlighter or write "donation" next to the organization name.

Get checkbooks with a carbon copy. If you routinely write a large number of checks, you may want to order checkbooks that produce a carbon copy at the time you write them. This will give you a record in case you forget to record a check.

Comments

0 comment