views

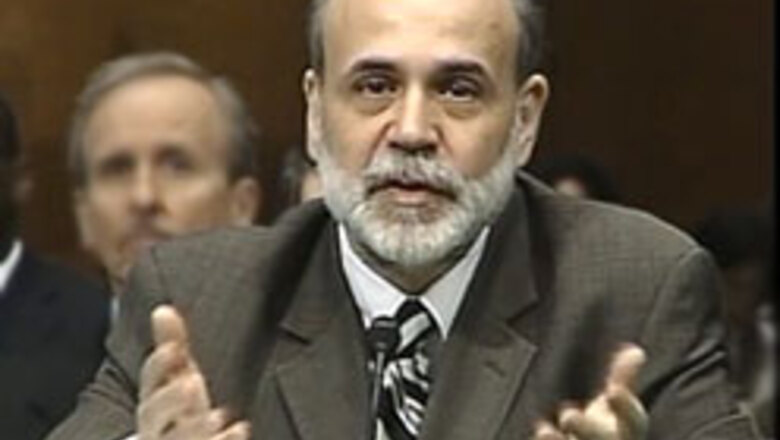

New York: Federal Reserve Chairman Ben Bernanke was named Person of the Year by Time magazine on Wednesday, a highly visible show of support at a time he seeks to beat back proposals that would erode the central bank's authority and independence.

Time credited Bernanke with creative leadership that ensured 2009 would be a year of recovery, however weak, rather than a catastrophic second Great Depression.

"The recession was the story of the year. Without Ben Bernanke ... it would have been a lot worse," Time Managing Editor Richard Stengel said in a statement.

"We've rarely had such a perfect revision of the cliche that those who do not learn from history are doomed to repeat it. Bernanke didn't just learn from history; he wrote it himself and was damned if he was going to repeat it."

Time's selection of Bernanke, an expert on the Depression, is sure to be noticed on Capitol Hill, where Fed-bashing has been the norm in recent weeks.

It comes a day ahead of a vote in the Senate Banking Committee on his nomination to a second term. His first four-year term as Fed chief expires on January 31.

Congress is considering proposals that would strip the Fed, which was due to close out a two-day policy meeting on Wednesday, of its regulatory authority over major banks and expose its interest rate decisions to audits.

One criticism that has been leveled at the Fed and the Obama administration is that despite efforts to prop up the financial system with billions of taxpayers' dollars, banks still show a reluctance to lend.

In an interview with Time, Bernanke said banks have been stabilised, but he conceded that lending remains too weak to support a healthy recovery.

"We have told the banks very clearly that we want them to make loans to creditworthy borrowers, where there are borrowers who can repay the loans," Bernanke said.

After a "near-death experience," banks are wary of taking on the kind of risk that led to the crisis, although they have rebuilt capital, he said.

Bernanke and his colleagues lowered overnight interest rates to near zero a year ago and have pumped more than a trillion dollars into the financial system to overcome the crisis.

Now, Bernanke said it was time to put in place reforms to ward off future crises. "We need to have extensive reform in the private sector, in the public sector, to eliminate these risks in the future," he said.

The Fed, along with the administration and Congress, still has a lot to do to get the economy back to stability and start creating jobs again, he said.

"Even though the recession may be technically over, in a sense that the economy is growing, it's going to feel like a recession for some time, because unemployment remains very high, about 10 per cent," he said.

He also said that Congress and the administration need to develop "a credible medium term ... strategy for fiscal policy."

The Obama administration had proposed making the Fed the lead regulatory policing the financial sector for 'systemic" risks. Bernanke said the Fed had never proposed that it be responsible for regulating the entire financial system, although he argued no other agency has its expertise.

"We have a wide range of expertise that makes us the natural supervisor for these large, complex firms," he said.

Banks have yet to broadly understand the need for more restraint on pay after they were bailed out with taxpayer money, he said.

The Fed instituted policies "which we'll be enforcing on banks" that require them to structure pay in ways that align it with performance and discourage excessive risk taking, he said.

"We are going to be looking at that as part of our supervision of banks," he said.

Comments

0 comment