views

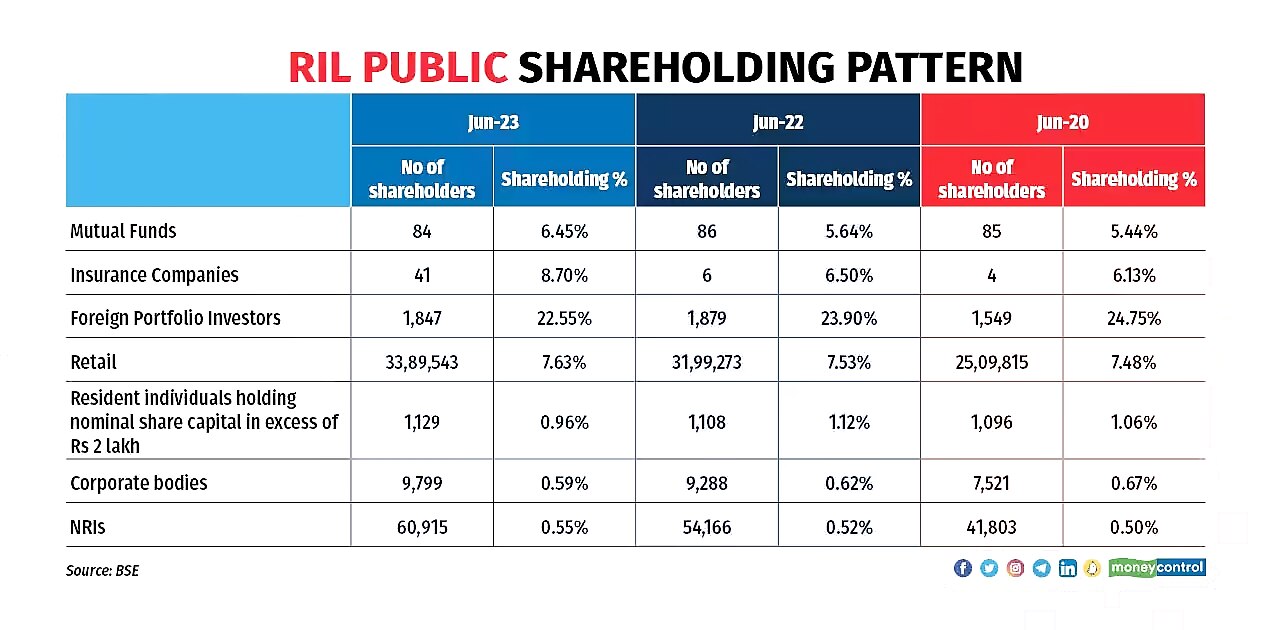

Mutual funds, insurance companies, as well as retail investors have increased their stake in Reliance Industries since the conglomerate’s last annual general meeting. RIL is all set to hold its 46th AGM on August 28.

Reliance AGM 2023 LIVE: Jio, Retail IPO Updates To 5G Plans, Devices: Here’s What All To Expect

An analysis of public shareholding in RIL shows the number of retail shareholders have gone up by 1,90,270 over the past year with aggregate shareholding up 10 basis points. Compared to June 2020, when retail investors were rushing into the markets during the Covid-19 lockdown, the number has gone up by 8,79,728 shareholders. Retail investors are categorised as those individuals investing up to Rs 2 lakh in a stock.

The number of mutual funds holding RIL shares has come down from 86 to 84 but the aggregate stake held by them has increased 81 basis points. Some active mutual fund schemes that increased holding in RIL during the past year include Kotak Equity Arbitrage Fund, SBI Flexicap Fund and Axis Bluechip Fund.

Insurance companies holding RIL has seen the sharpest jump in the past year, from 6 to 41. But this could be due to market regulator Sebi amending the shareholding reporting format in June 2022, said analysts.

Among insurance companies, LIC continues to hold the biggest pie with over 6.5 percent stake. As a result of its holding in RIL, LIC also holds 6.66 percent stake in Jio Financial Services as investors were issued 1 share for 1 held, in the demerger.

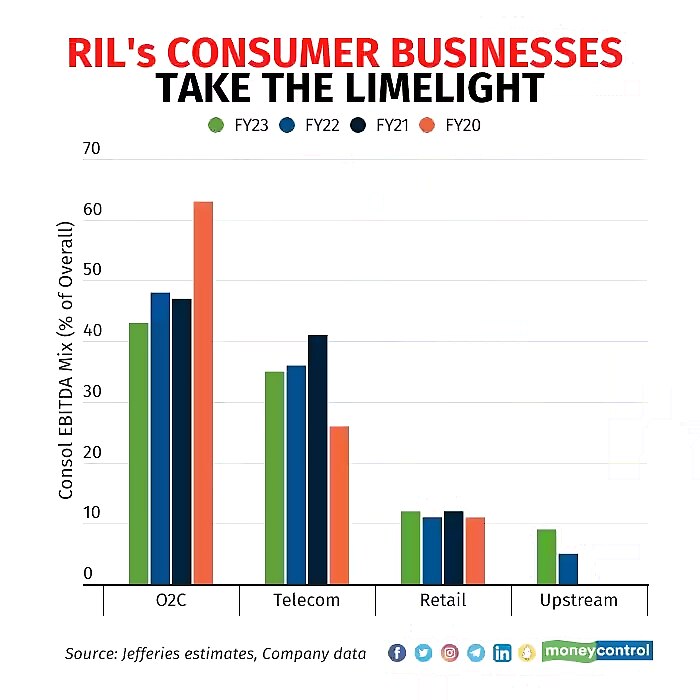

Domestic investors’ optimism has steadily increased, despite the cyclical weakness in oil-to-chemicals (O2C) business, as the conglomerate focuses more on its Jio and Retail business. According to Vikash Kumar Jain of CLSA, the ramp-up of itss FMCG business, launch of Airfiber to catapult wireless broadband penetration and a new affordable 5G smartphone to monetise its pan-India standalone 5G network by end-2023 along with an IPO of Jio and/or retail are all possible large triggers in H2FY24.

When it comes to O2C, JP Morgan believes that the business deserves a multiple higher than or in-line its historical average of 7-9x EV/EBITDA when it was a pure refiner and petrochem company, given the company’s “best-in-class assets, scale and integration”.

On the other hand, foreign portfolio investors have reduced their stake by 135 basis points in RIL over the past year. Compared to June 2020, their stake is 220 basis points lower. That said, Reliance Retail Ventures and Jio Platforms, the subsidiaries that house the consumer businesses, have seen a flush of foreign investors coming in over the past two years. These do not reflect in shareholding of RIL, said analysts.

With AGM knocking on the door, investor expectations from India’s largest company by market capitalization are running high. From IPO timelines to new energy business, the Street is pinning its bets on significant announcements from the conglomerate.

Comments

0 comment