views

Annualizing a Non-Compounding Interest Rate

Determine whether or not your interest rate compounds annually. This should be listed in your loan contract or investment documents. Interest rates may also compound quarterly (4 times per year), monthly, or weekly. If your compounding rate is anything other than annually, you should go to annualizing a compounding interest rate to calculate your rate. Credit cards, for example, may advertise monthly interest rates, like 1 or 2 percent, but they have to show borrowers the annualized rate when they sign credit contracts. This will be listed as the annual percentage rate, or APR, on the contract.

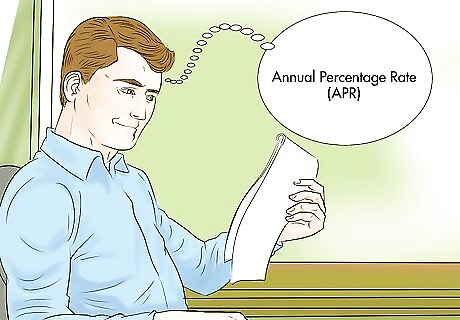

Find out the period interest rate. This is the amount of interest earned or paid each period. Again, this can be weekly, monthly, or quarterly. For example, you might pay 1 percent per month in credit card interest. This is your period interest rate. For the purposes of calculating the annualized rate, you will have to know your period interest rate expressed as a decimal. You can find this value by dividing the stated period interest rate by 100. For example, 1 percent would be 1/100, or 0.01.

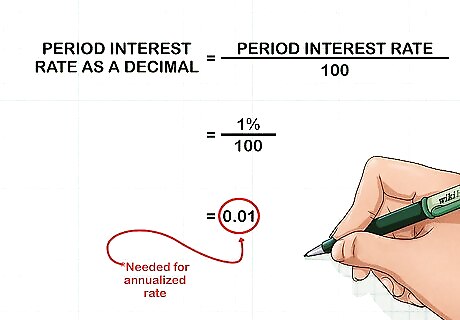

Determine the number of periods in a given year. This is the number of interest periods there are in one year. For a stated monthly interest rate, there would be 12 period in a year. Similarly, a loan or investment using a weekly interest rate would have 52 periods in a year and one with a quarterly rate would have 4. Alternately, a bond payment may make semiannual interest payments. This would be 2 payment period per year.

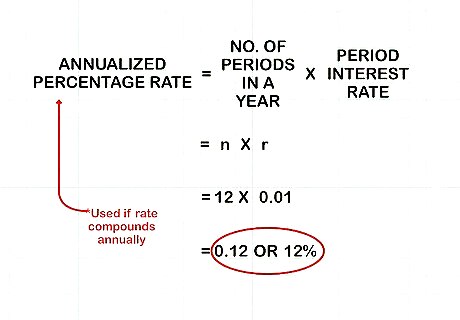

Calculate the annualized percentage rate. The annualized percentage rate can be calculated using the following formula: n ∗ r {\displaystyle n*r} n*r. In the formula, n represents the number of periods in the year and r represents the period interest rate. For example if you were quoted a rate of 1 percent per month (r=0.01, n=12), compounded annually, your annualized interest rate is 12 ∗ 0.01 = 0.12 {\displaystyle 12*0.01=0.12} 12*0.01=0.12 (or 12%). This calculation should be used if the rate compounds annually, rather than quarterly, monthly, or some other frequency.

Annualizing a Compounding Interest Rate

Determine how your interest will compound over the course of one year. Understand if your rate compounds annually only (meaning that interest is calculated and accumulates only once per year) vs monthly (or over a different period). If your interest rate compounds at a frequency other than annually, use annualizing a non-compounding interest rate to calculate your annualized rate. Otherwise, use the method for annualizing non-compounding interest rates.

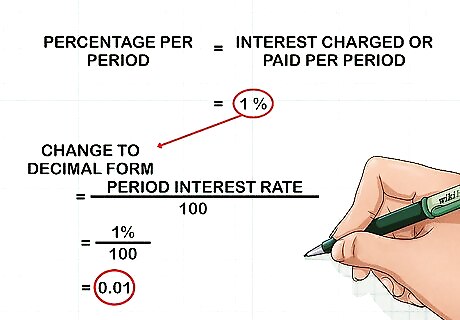

Find the percentage rate per period. This is the amount of interest charged or paid each period. For example a monthly interest rate of 1 percent would be a 1 percent period interest rate. If you assume that the interest rate will remain the same for the rest of the year, you can annualize this percentage. Note that in order to calculate the annualized percentage, this number will have to be converted to decimal form. You can do this by dividing the stated period interest rate by 100. For example, a 1 percent period rate would be expressed as 0.01 (1/100).

Find the number of periods. This represents the number of times the periodic percentage rate will be compounded during the year. For example, a periodic percentage yield quoted as once per month will be compounded 12 times during 1 year.

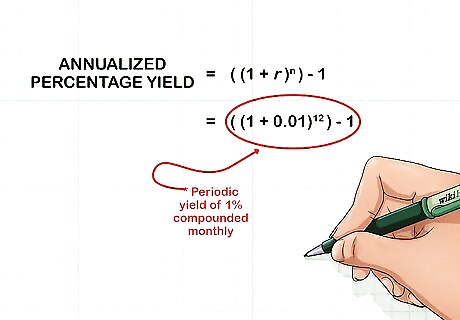

Input your variables into the formula. The annualized percentage yield is calculated with the formula ( ( 1 + r ) n ) − 1 {\displaystyle ((1+r)^{n})-1} ((1+r)^{{n}})-1. In the formula, r represents the period rate and n represents the number of periods. For example, a periodic yield of 1 percent compounded monthly would be calculated as ( ( 1 + 0.01 ) 12 ) − 1 {\displaystyle ((1+0.01)^{12})-1} ((1+0.01)^{{{12}}})-1.

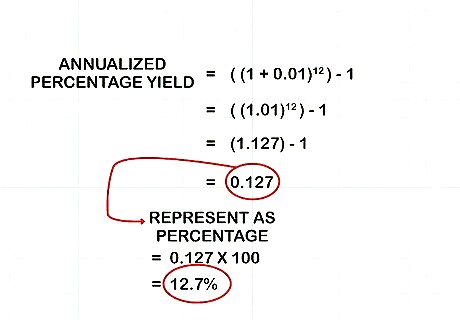

Solve the equation. Calculate each part of the equation using the proper order of operations. Start by adding the figures within parentheses. After adding these numbers (1 + 0.01), your equation should look like this: ( ( 1.01 ) 12 ) − 1 {\displaystyle ((1.01)^{12})-1} ((1.01)^{{{12}}})-1 Solve the exponent. This is done by entering the lower number (1.01 in this case), pressing the exponent button (which is usually x y {\displaystyle x^{y}} x^{y}), entering the higher number (12) and pressing enter. The equation should now be: ( 1.127 ) − 1 {\displaystyle (1.127)-1} (1.127)-1 The result, 1.127, has been rounded to make calculation simpler. Keeping more decimal places will make your calculation more accurate. Subtract the one. This gives: 0.127 {\displaystyle 0.127} 0.127. Represented as a percentage, by multiplying by 100, this is 12.7 percent. So, an interest rate of 1 percent compounded monthly gives an annual percentage rate of 12.7 percent.

Annualizing Year-to-Date Returns

Determine when to use this calculation. In some cases, particularly for investments, your returns may not be clearly stated as monthly, quarterly, or weekly rates. In this case, you will have to use year-to-date calculations to annualize your rate of return. This is not a useful calculation for determining an annualized rate for interest payments or calculating any interest rate that compounds during the year. However, it is useful for getting a better idea of an investment's performance on an annual basis so that it can be compared to other investments.

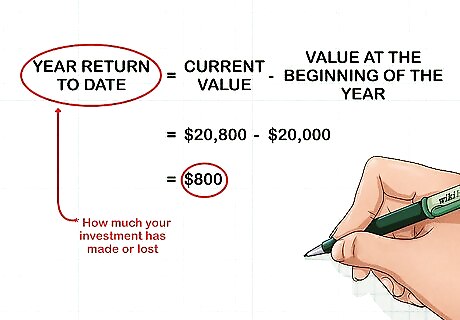

Find this year's return to date. Find how much your investment had made or lost this year in dollars (or your local currency). This is done by subtracting it's value at the beginning of the year from its current value. For example, an investment with a value of $20,000 at the beginning of the year and $20,800 now would have a year return to date of $800 ($20,800-$20,000).

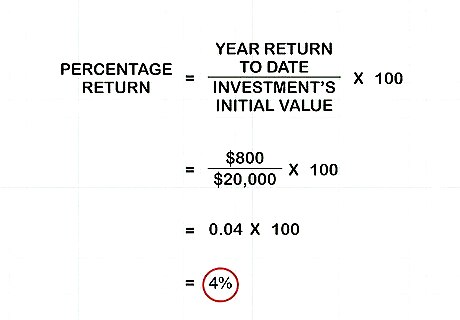

Convert this number into a percentage return. This is done by dividing the year return to date by the investment's initial value and then multiplying by 100. For the previous example, this would be $800 (the year return to date) divided by $20,000 (the initial value), to get 0.04. Multiply this number by 100 to get the percentage return, which would be 100*0.04, or 4 percent.

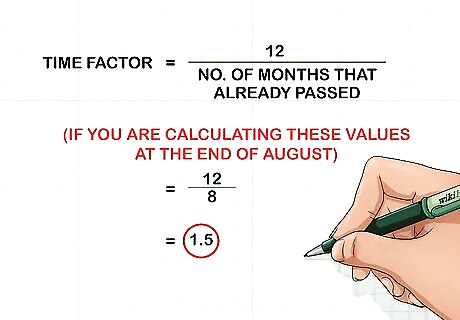

Calculate the time factor. The time factor calculates how much of the year has passed. This number is then used to annualize the percentage return. To calculate this number, divide the number of months that have already passed in the year by 12. For example, if you are calculating these values at the end of August, this would mean that 8 months have passed in the current year. In this case, your time factor would be calculated as 12 divided by 8, which would give a time factor of 1.5.

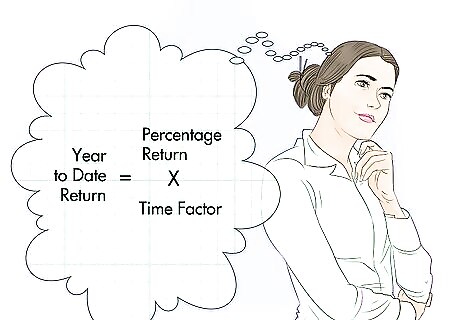

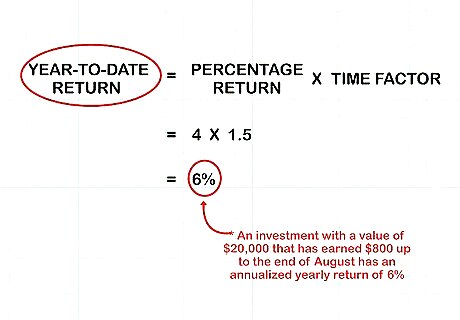

Solve for the year-to-date return. Multiply your percentage return by your time factor to get the year-to-date return. This results reflects how the investment is performing on an annual scale and this number can now be used to compare this investment's return to investments with different time periods. For the previous example, this number would be the percentage return, 4 percent, multiplied by the time factor, 1.5, to get a 1.5*4, or 6 percent, year-to-date return. So, for an investment with a value of $20,000 that has earned $800 up to the end of August, the annualized yearly return would be 6 percent.

Comments

0 comment