views

Early Retirement is a dream many nurture to be free from the burden of earning just to make a living, and pursue the career of their choice, doing things they would love to do, the rest of their life. So, what if you are just pursuing college and you’ve decided to retire at 36? When you should start saving to have a decent corpus with you by the time you step at the mid of an average lifetime to call it a day at your workplace, and retire to follow your instincts?

Well the answer is ‘Start Saving Now’. As per financial experts, the best time to start saving was yesterday, and the second best time is ‘today’. For the young individuals, who have just started on the path of financial freedom and aim early retirement in less than 2 decades from now, this is the right time to start saving. As proven in financial calculations, the compound interest factors in the best interest of those who start saving in as early as their 20s.

Here are some ways you can too, to ensure you have your financial goals met by the time you are in your mid-thirties and have a decent source of income to take care of your retirement expenses:

1. Get Aggressive

Early retirement may sound a bed of roses, however, the way that leads to this stage need not be full of thorns if you plan your savings aggressively. Understand, it is an aggressive goal and saving just about 10-20% of your income via SIP or traditional investment instruments is not going to make you achieve your early retirement goal. By doubling your savings in 20s you are reversing time by half to build your financial corpus.

In your 20s, you don’t have much financial burdens. If you can keep yourself focused on saving at least 50% of your income towards Retirement SIP than spending on gadgets or buying a car/bike, you can set the pace for your early retirement.

2. Watch Your Expenses

If you can control your expenses in your elementary years of earning, you can stash more cash away for your retirement planning. Steer clear of health and money deteriorating habits like smoking and drinking, if you analyze monthly expenses these are the two heads that will take the biggest pie on an average Indian’s monthly personal spending. Similarly, to be able to save 50% of your income, you must limit eating out or frequent traveling, go running or do yoga at home or use gym at your workplace rather than taking a high-end gym’s membership, etc.

3. Maintain What’s In Hand

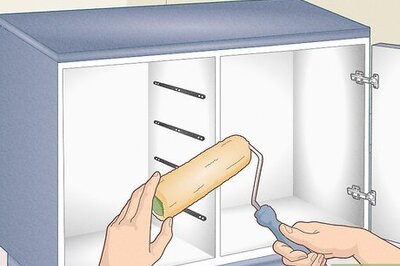

Money saved is money earned! Therefore, take care of the gadgets you already own. To save money, you need not always buy a cheap product, if you wish, go for a high-tech gadget, however maintain its shelf-life. Same goes with other assets, your car, your home, your appliances; get regular repair done at the right intervals to maintain these assets and increase their lifetime and you’ll end you saving more money.

4. Aim to be Debt Free

If you wish to go big on savings, then say no to personal loans. Personal loans carry the highest interest riders and can suck your savings for 5 years to completely throw you off the retirement planning way. Clear your credit card bills on time to avoid interest charges. Pay bills on time to save on late fee penalties. If you have taken a home-loan, try to pre-pay it every quarter to lower your interest burden. This way, you’ll save money that goes out as interest on various types of loans.

5. Generate Second Income

With the advent of digital media, it is easy to generate decent second income by sparing just 2-3 hours of your day’s time. Become a free lancer or an affiliate, sells things online or give tuition classes post work, become an Em Cee or figure out how you can make more money out of your craft. Save this entire money and let it compound.

6. Marry a Like-Minded Partner

Well this last advice doesn’t find its place in financial books, however, it is highly relevant to your financial goals. It is important to marry a like-minded partner. If your partner is a spend thrift or a globe trotter, then it will be extremely difficult for you to match pace with your savings. For cutting down on food bills, you’ll be termed miser; and so on. Therefore, clarify your financial goals with the person you wish to marry and see if you have anything in common in this space or how you work out differences here...

Comments

0 comment