views

‘Green finance’ as a term first came into the picture along with the green economy in connection with poverty eradication and sustainable development at the United Nations Conference on Sustainable Development, Rio de Janeiro, Brazil, in 2012.

Green finance is always connected with sustainable finance. The objective of green finance is to understand and manage environmental risks, thereby identifying opportunities that generate environmental or green benefits with a fair rate of financial benefits. Green financing includes instruments like green bonds, green insurance, green banks, carbon financing, and community-based green funds.

India is ranked as the 5th most vulnerable nation to the impact of climate change at 2.5 to 4.5 per cent of its gross domestic product per year. Various estimates suggest that India will be requiring about two and a half trillion dollars to meet its climate action changes from 2015 to 2030 under the Paris Agreement.

The Role of NBFCs/Banks In Tackling Climate Change

The banking sector has been the backbone of India’s commercial activity through its transition into a major economic powerhouse. It is still a major source of funding for industries even though several other avenues, such as bond and equity markets, have grown exponentially alongside it.

Today, technology plays a pivotal role in net-zero transition for several sectors and is evolving rapidly. Some areas include electrifying transportation, making energy-efficient buildings, reducing GHG emissions from the industrial and agricultural sectors, remaking the power grid to supply clean electricity, hydrogen fuel cells and expanding carbon capture, use, and storage – all of which require a strong financial boost of up to $2 trillion for a faster transition towards Net Zero.

Enablers for Scaling up Green Finance in India

In order to give focused attention to scaling up green finance, banks and financial institutions would have to invest in human resources and capacity-building efforts as well as integrate environmental and social risk considerations into their corporate credit appraisal mechanisms.

A taxonomy would also help banks and financial institutions in better assessing the climate risk in their loan portfolio, scaling up green and sustainable finance and mitigating the risk of greenwashing.

Another key challenge in scaling up green finance is the availability of a robust ecosystem for third-party verification/ assurance and impact assessment and the green credentials of businesses and projects.

Green infrastructure investment trusts could help scale up green finance as also deepen the local bond market.

Policy Initiatives for Banks in Tackling Climate Change

To enable banks to operate and develop this sustainable ecosystem, the policy framework is of paramount importance. Fiscal measures such as a supportive taxation policy for green finance would help bring transaction costs down and promote better lending. Besides, India also needs green infrastructure investment trusts to facilitate deeper green bond markets, and green finance instrument innovation.

All sectors are interdependent and a nudge at one corner may not be enough. Making a holistic difference should take centre stage. Greater public awareness, information sharing, and constant research and development should help bring about the real shift.

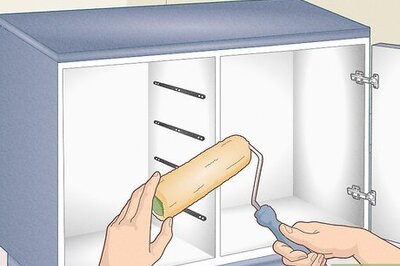

Other public policies includes that there are several corporates who has shown their keenness towards expanding ‘green buildings’ those are more environment friendly. Government of India should try to encourage this organisation. Collaboration can also be possible to have a common approach.

Need To Work Together

The central bank and governments need to work together to develop reliable green financial policy frameworks that are more environmentally sustainable in the long run. Technology risk and credit risk need to be handled carefully. Funding is required for research and development of new green technology.

There is a need for regulated entities to develop and implement comprehensive frameworks for understanding and assessing the potential impact of climate-related financial risks in their business strategy and operations. Collective engagement would help build on our early progress and go a long way in addressing the challenges of climate change.

We have to incorporate climate risk and ESG-related considerations into commercial lending and investment decisions while simultaneously balancing the needs of credit expansion, economic growth, and social development.

(The author is chief business officer of Kissandhan Agri Financial Services Private Limited. He has over 15 years of experience in rural and agri banking space)

Read all the Latest Business News, Tax News and Stock Market Updates here

Comments

0 comment