views

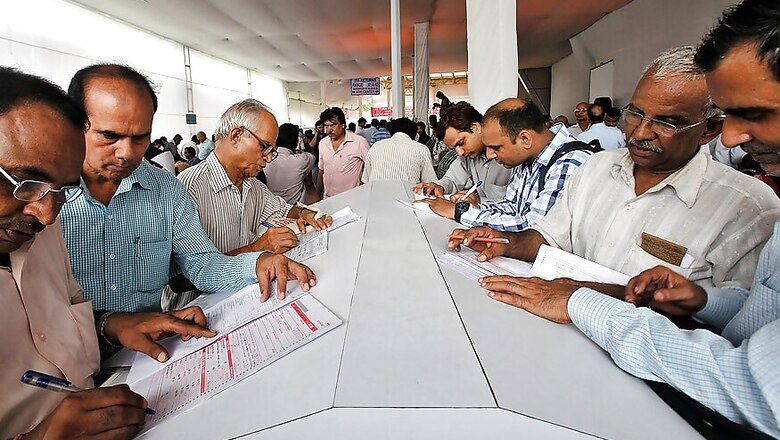

New Delhi: The online filing of income tax returns (ITRs) showed a marked improvement during FY 2018 compared to the corresponding period in the preceding year, the Central Board of Direct Taxes (CBDT) said in a statement on Saturday.

The ITRs e-filed up to August 31, the extended due date of filing from March, were 5.42 crore compared to the 3.17 crore last year, signalling an increase of 70.86 per cent. Almost 34.95 lakh returns were uploaded on the last date itself.

There was also a rise in the number of ITRs filed by salaried Individuals (ITR-1& 2) and those availing the benefit of the Presumptive Taxation Scheme (ITR-4).

The total number of e-returns of salaried individual taxpayers increased to 3.37 crore from 2.19 crore returns filed during the corresponding period of 2017, registering an increase of 1.18 crore returns that translates into a growth of almost 54 per cent.

The board said it also marked an upward trend in the number of returns e-filed by persons availing the benefit of Presumptive Tax, with 1.17 crore returns having been filed up to August 31 this year compared to 14.93 lakh returns in the corresponding period last year. This brought a massive increase of 681.69%.

Noting the increase in the number of returns, the CBDT said it revealed a marked improvement in the level of voluntary compliance by taxpayers which could be attributed to factors such as the impact of demonetisation, enhanced persuasion and education of taxpayers apart from the impending provision of late fee.

The board called it an “indication” of an India moving steadily towards a more tax compliant society, adding that it reflected the impact of continuous leveraging of technology to improve taxpayer service delivery.

Finance minister Arun Jaitley had in Budget 2018-19 flagged the tax mop-up from entities under the Presumptive Taxation Scheme.

Under this scheme, 41 per cent more returns were filed during this year which shows that many more persons are joining the tax net under simplified scheme. However, the turnover shown is still not encouraging, he had said.

The government had liberalised the presumptive income scheme for small traders and entrepreneurs with annual turnover of less than Rs 2 crore and introduced a similar scheme for professionals with annual turnover of less than Rs 50 lakh with the hope that there would be significant increase in compliance.

Comments

0 comment