views

Classifying the Advance Payment

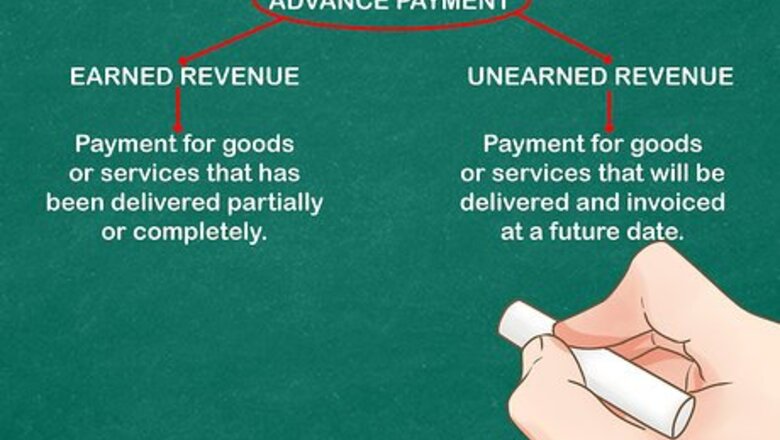

Qualify the type of advance payment. This depends on whether or not the goods or services have been delivered. The advance payment is classed as earned revenue if the payment is for goods and services that have been partially or completely delivered to the customer, but have not yet been invoiced. The advanced payment is classed as unearned revenue should the payment be for goods and services that will be delivered and invoiced at a future date, since the seller has not yet provided any benefits to the buyer.

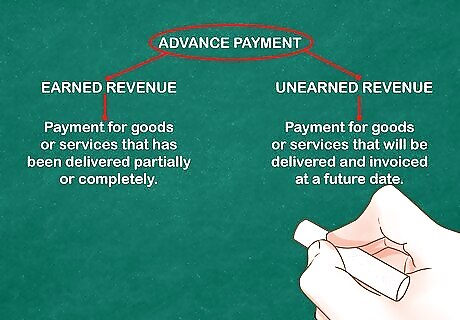

Create a special account in the company accounting journal. Label it "Customer Deposits" or "Prepaid Sales." You might think a customer deposit would be straight income, but since you "owe" the customer something, it's actually a liability to the business.

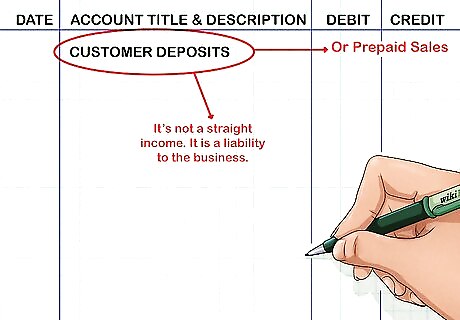

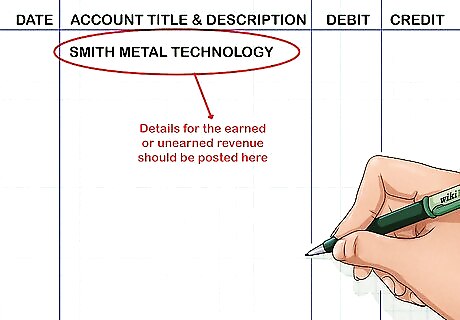

Relate the advance payment to a customer account. If this is new client, create a customer account in the accounting records. The detail for the earned or unearned revenue should be posted in that account as well, pending further actions such as filling the order and creating the invoice for that order. For example, you would create an account called "Smith Metal Technology."

Accounting for Customer Deposits

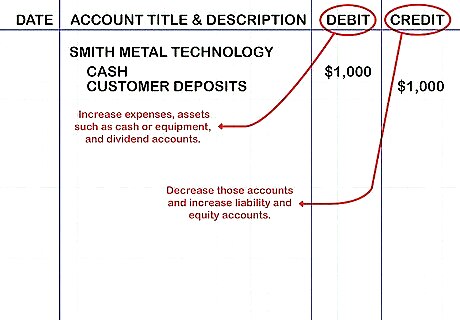

Record the amount of the deposit from the customer. In your accounting journal, debit the Cash account and credit the Customer Deposits account in the same amount. Debits increase expenses, assets such as cash or equipment, and dividend accounts. Credits decrease these accounts and increase liability and equity accounts. For example, when Smith Metal Technology makes a $1,000 deposit, debit Cash for $1,000 and credit Customer Deposits for $1,000.

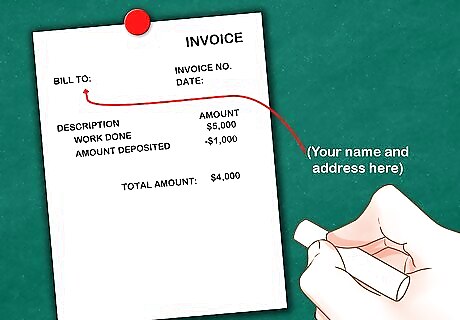

When the work is completed, send an invoice to the customer. Note on the invoice the amount of the deposit previously paid and subtract it from the total amount owed. Revenue can be recognized when the work has been completed and the customer has been invoiced, not when the money is received. For example, if the total invoice is for $5,000, deduct the $1,000 deposit to total $4,000 owed.

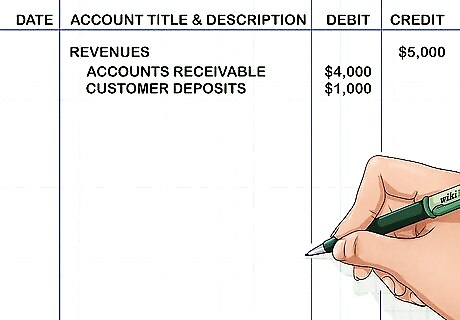

Record the transaction in your accounting journal. Revenues are credited $5,000, Accounts Receivable is debited for $4,000, and Customer Deposits are debited for $1,000. This is how you record the revenue to the company - by converting a liability (work owed) into an asset (accounts receivable).

Posting to Company Reports

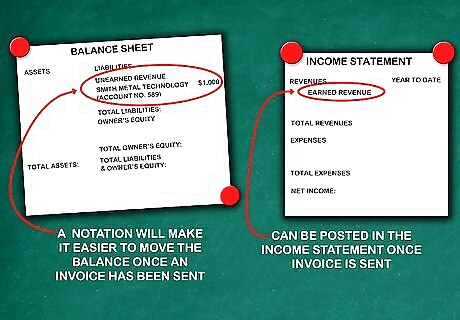

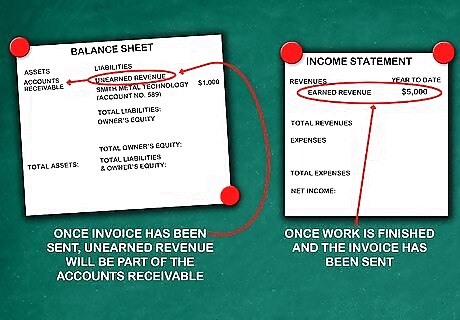

Post the advance payment. This will be on either the balance sheet or the income statement based on the payment classification (which is based on whether or not a percentage of the work/service has already been delivered). If classed as "unearned revenue", the amount may be posted to the company balance sheet as a liability under the unearned income/revenue line item. A notation that connects the revenue with the specific customer's account number will make it easier to move the balance once an invoice is created. For example, on the balance sheet you would have a line item stating Unearned Revenue, $1,000 Smith Metal Technology, account number 589. Earned revenue can be posted to the company's income statement, once an invoice has been sent.

Complete the transactions once the invoice is posted. This will move the unearned income from the balance sheet, since it can now be counted as a payment on a specific invoice number found in the open accounts payable and considered part of the receivables for the period. Earned income in like manner can be moved from an outstanding line item on the income statement applied toward the balance of the invoice. The income statement would state "Revenue $5,000" after the work is completed and the invoice sent.

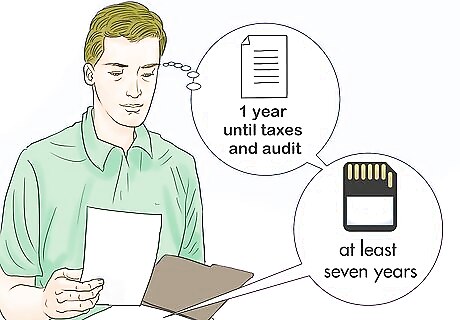

Keep good records. Paper copies of all documents related to each customer payment should be kept for at least one year until your accounts have been audited and your taxes filed. Then you can save documentation electronically for at least seven years.

Comments

0 comment