views

X

Research source

Here, we'll show you exactly what you need to do to write a valid will in Texas so you know that when you pass, your assets will go to the people you want them to.

Drafting Your Will in Texas

Handwrite your will if your estate is very small. Technically, anyone can handwrite their will in Texas. It's called a "holographic will," and it's valid as long as someone who knows you testifies that the will is in your handwriting. But at the same time, handwritten wills are extremely vulnerable to attack because it's really easy for a family member to say it's not your handwriting. This is more likely to happen if you have a lot of assets. Handwritten wills aren't the best idea for most people because it's just so hard to get them to hold up in court. But if you don't own a home or any significant property, it might not be that big of a deal.

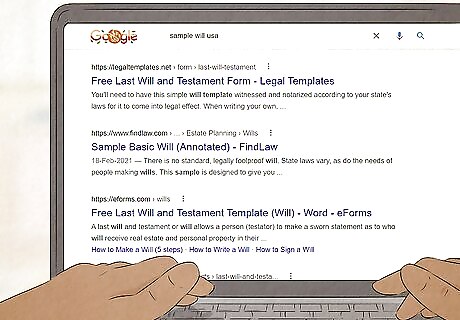

Find a free template online to make drafting easier. Some city and county courts have templates or forms you can use to draft a simple will. You might also be able to find samples or books that will help you at the law library in your local courthouse. These templates have all the formal language you would typically associate with wills—you just fill in the blanks with the names of your information, such as the names of your beneficiaries and your property. There are a lot of sites online that offer will forms and templates. Some are free while others require you to pay a fee or buy a subscription for services. It can be worth it to pay a fee for documents if they're reviewed by a Texas attorney. Otherwise, you're probably better off using a free template or form.

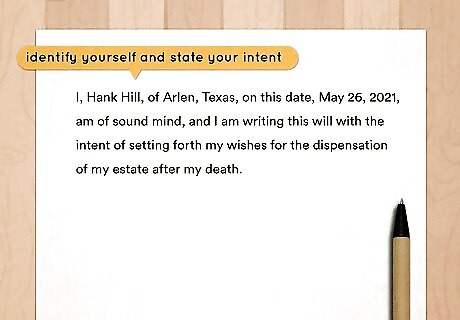

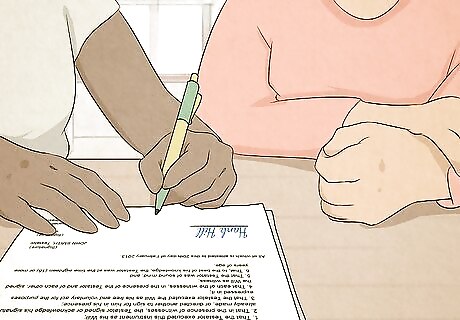

Start by identifying yourself and clearly stating your intent. Title your document "Last Will and Testament." That lets anyone who reads the document know what it is immediately. Then, recite your name in the first paragraph along with a statement that you meet the legal requirements to make a will. For example, you might write, "I, Hank Hill, of Arlen, Texas, on this date, November 26, 2021, am of sound mind, and I am writing this will with the intent of setting forth my wishes for the dispensation of my estate after my death."

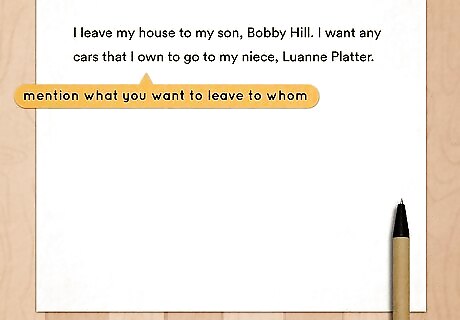

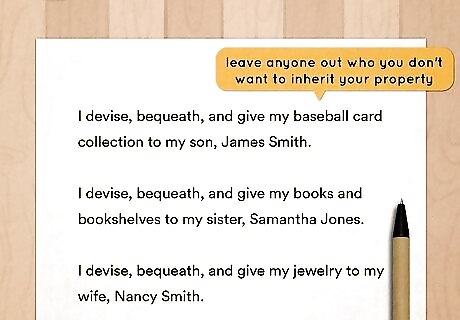

List the assets you want to leave to specific people. If you're related to the person, include their relation to you. Keep in mind that if you're married, you only have a 50% interest in assets acquired during the marriage—your spouse has the other half. This means that if you leave the marital home to your son in your will and your spouse is still living, he only gets a 50% interest in that property. For example, you might write, "I leave my house and my car to my son, Bobby Hill." If your wife lives in the house, your son would get a 50% interest in the house, while your wife would retain the other 50%. The only caveat here is that the person will only get the thing you listed if you still own it when you die. You can get around this restriction by listing categories of things, rather than specific things. For example, you might say, "I want any cars that I own to go to my niece, Luanne Platter." If you want to list something specifically, that's fine—just keep in mind that if something happens to that thing before you die, that person won't get anything. For example, if you write, "I give my 1957 Thunderbird to my niece, Luanne Platter," Luanne won't get anything if you sell your T-bird before you die.

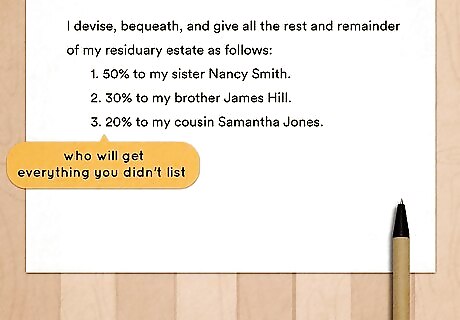

Name the person who will get everything you didn't list. No one expects you to list every single thing you own in your will. Instead, you list the things you want to go to a specific person, then leave whatever's left (the law calls it the "residue" or "remainder") to someone. Usually, it's a person, but it could be a nonprofit organization as well. For example, you might write, "I leave the residue and remainder of my estate to my son, Bobby Hill."

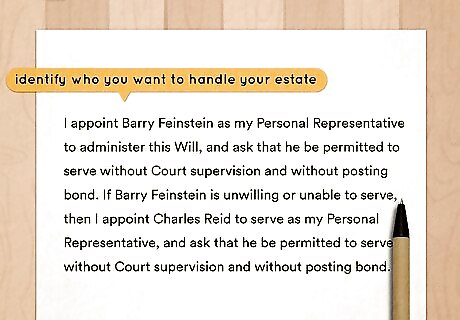

Identify the person you want to handle your estate. This person might be referred to as your "executor" or your "personal representative," and they deal with all the legal and financial matters involved in wrapping up your estate after you're gone. Whoever you choose, talk to them before you list them in your will. Make sure they understand what they'll need to do and agree to do it—it's a huge responsibility. If you have fairly complex assets, you might choose your accountant or attorney to be your executor instead of saddling a family member with the responsibility. If you're writing your will yourself, make sure you include a statement that you want your executor to "serve without bond." Courts usually require executors to put up money with the court to make sure no assets are stolen or misused. As long as you trust the person you name, including this language means they won't have to do that.

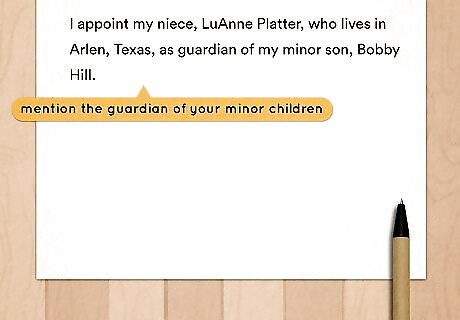

List the person you've chosen as guardian of your minor children. If you currently have kids, this ensures that they'll be in the care of the person you choose if something should happen to you before they're adults. Provide the guardian's full name and where they live. For example, you might write, "I appoint my niece, LuAnne Platter, who lives in Arlen, Texas, as guardian of my minor son, Bobby Hill." You don't have to name your kids. This ensures any kids you might have in the future are included. For example, you might write, "I appoint my niece, LuAnne Platter, who lives in Arlen, Texas, as guardian of my minor children." This clause typically only takes effect if both parents are gone. If the child's other parent survives you, they're considered the natural guardian. You don't have to name them for that to happen.

Leave anyone out who you don't want to inherit your property. Texas doesn't have a "forced share" for spouses, former spouses, or children. This means that if you have a will, the only people who will get any of your property are the people listed in that will. If you want to leave someone out, simply don't include their name in the will. Since there isn't a forced share, you don't have to include any specific language to disinherit anyone. A surviving spouse is entitled to half of the assets acquired during the marriage, but this isn't the same as inheriting that property. That's the property they already owned. For example, if you buy a house while you're married, your spouse has a 50% interest in that house, even if their name isn't on the deed. But you can still leave your 50% interest to anyone you want—you don't have to leave it to your spouse.

Hire an attorney to draft your will if you have a lot of assets. There's no legal requirement that you hire an attorney to write your will in Texas. But at the same time, if you have a lot of assets (especially real estate) or complex investments, it's better to hire an attorney so you can make sure everything's going to be divided the way you want it to be. It's also a good idea to hire an attorney if you want to specifically disinherit someone. They'll give you that extra peace of mind that your wishes will be carried out and your documents will hold up in court. Look for an attorney who specializes in wills and estates or probate law. It's also good to choose an attorney who has experience with estates similar in size and makeup to yours.

Executing Your Will in Texas

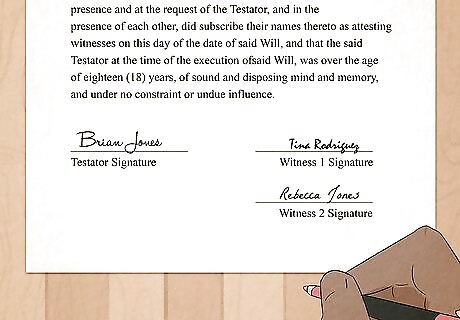

Choose 2 witnesses to watch you sign your will. The only legal requirement for your witnesses is that they have to be at least 14 years old. It's okay if they're listed as beneficiaries. You don't need witnesses if you have a handwritten will. But if you get witnesses anyway, it turns your handwritten will into a "formal" will—which means your family won't have to worry about finding someone to testify that it's your handwriting.

Go to a notary public with your witnesses. You don't need to sign your will in front of a notary in Texas. But if you do, that means your will is "self-proved." This makes it easier for your beneficiaries because they don't have to call your witnesses to testify that they saw you sign it. Do not go to a "notario" or "notario publico." A licensed notary public is not allowed to use these words or phrases to advertise their services. In fact, they're not allowed to advertise in any language other than English.

Sign your will in front of your witnesses and the notary. First you'll sign, then your witnesses sign to verify that they watched you sign the will. Then, the notary will sign and affix their seal. It's a good idea to sign in blue ink—that way there's no question that this will is the original one and not a copy.

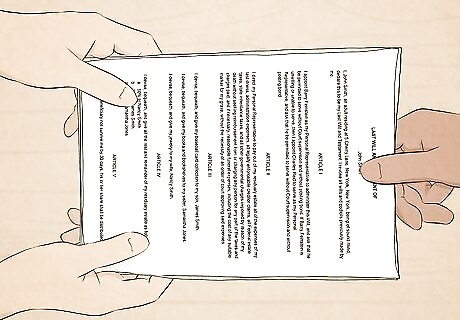

Ask the notary to make and certify several copies. The notary will charge you $0.50 a page for your copies. It's a good idea to make at least 3 copies so you can distribute them for safe-keeping. For example, you might keep one copy in your own safe deposit box, give one copy to your partner, and give the third copy to the person you named as executor.

Deposit your original will with the county clerk. The clerk's office will have an official envelope you can place your will in. Once that envelope is signed, it can only be opened by your executor. Write the name of your executor on the outside of the envelope along with your own. If you're married, you might include your spouse's name as well, even if they're not your executor. The county clerk will keep your will safe until your death. This is especially important if you have a handwritten will because only the original can be probated—a copy won't do. To get contact information for your county clerk, go to https://www.sos.state.tx.us/elections/voter/cclerks.shtml and scroll through the list until you find the county where you live.

Revoking or Changing Your Will in Texas

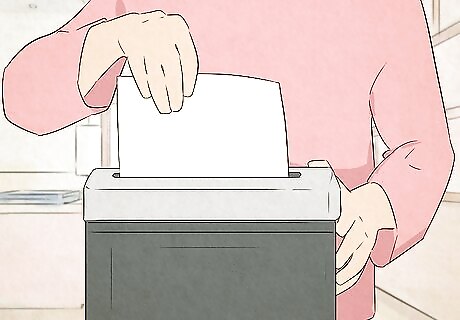

Shred or burn all copies of your will to revoke it entirely. If you know where all the copies of your will are, this is the easiest way to revoke it. If all copies of your will are destroyed, it no longer exists. If you've deposited your will with the county clerk, you can go to the clerk's office and ask for it. They'll release it to you before your death. After you get it, all you have to do is destroy it.

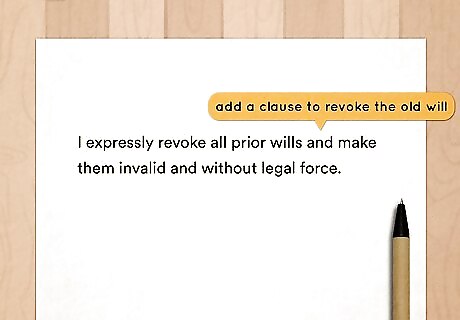

Add a clause revoking the old will when you write a new will. If you make an entirely new will, you can include a statement in it that it revokes any older wills you've made. Keep in mind that you still have to properly execute it so it's valid or it won't have this effect. For example, you might write, "I expressly revoke all prior wills and make them invalid and without legal force." You should still destroy your old will, but if a copy happens to surface, this clause makes it clear which will is valid.

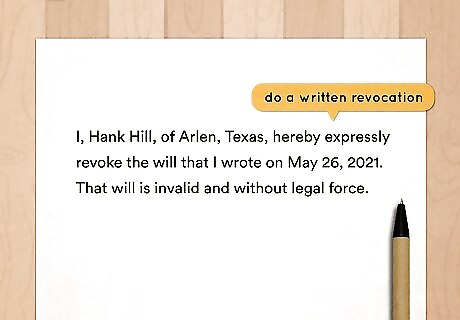

Do a written revocation if you don't know where your will is. If you don't want to make another will, you can also write down a statement revoking your previous will and declaring it invalid. Sign it in front of 2 witnesses, just like you signed the original will (they don't have to be the same witnesses). To be super safe, it's also good to sign your statement in front of a notary. For example, you might write, "I, Hank Hill, of Arlen, Texas, hereby expressly revoke the will that I wrote on November 26, 2021. That will is invalid and without legal force."

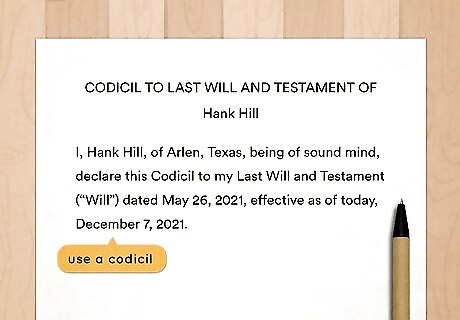

Use a codicil to make small changes to your original will. A codicil is a separate document that references your original will. As long as you reference the original will specifically, the probate court interprets the two documents as one. Your codicil also has to be executed the same way as a will does. To specifically reference your original will, include the date it was written or executed (or both). You might even attach a copy of the original will for reference. Your codicil doesn't have to be executed the same way as your original will, it just has to be executed in a way that makes it legally valid. So, for example, you could handwrite a codicil and sign it yourself, and it would be valid as a holographic will—you wouldn't even need witnesses. Keep in mind, though, that you want to make things as simple as possible for your beneficiaries. A holographic will would still require testimony from someone who knew you and could affirm that it was written in your handwriting.

Comments

0 comment