views

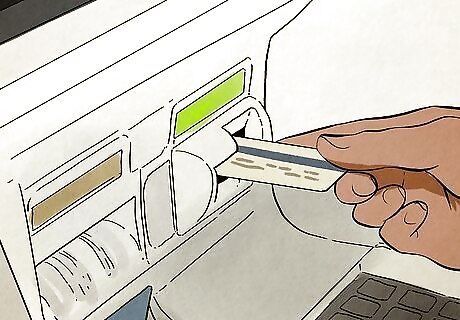

- Insert your card into the ATM with the card’s chip facing forward. Enter your PIN, then follow the onscreen prompts to complete your transaction.

- Whenever possible, use ATMs affiliated with the bank that issued your card. You may be charged additional fees if your card doesn’t match the ATM’s bank.

- For your safety, use ATMs in well-lit, high-trafficked areas. Remember to take your card, cash, and receipt at the end of your transaction.

Accessing Your Account

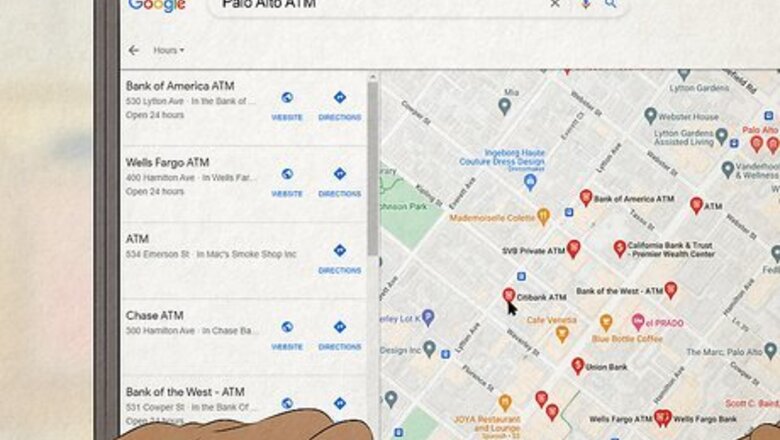

Locate a nearby ATM using map software. If possible, find an ATM that matches the bank that issued your debit card (like using a Chase debit card at a Chase ATM). Though you can use your debit card at any ATM, you may be charged additional fees for withdrawing money from an ATM that’s not affiliated with your bank. Some ATM services, like depositing cash, may only be available at ATMs that match your bank. You may also be charged additional fees by your bank and the ATM itself. Call your bank in advance to report travel plans and ask if there are extra fees for international ATM withdrawals.

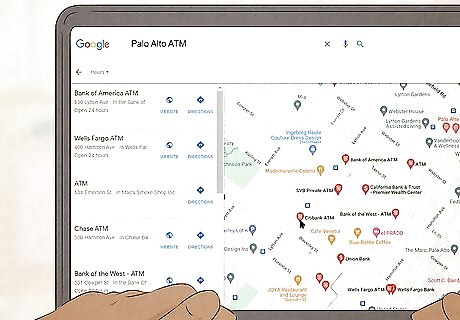

Check your surroundings to ensure you’re safe. Make sure the area is well-lit; in most cases, you won’t have to worry about your safety, but be on your guard and stand in front of the ATM so that your screen and key presses are not visible to anyone around you. If possible, choose ATMs in well-trafficked areas and use them only during the day.

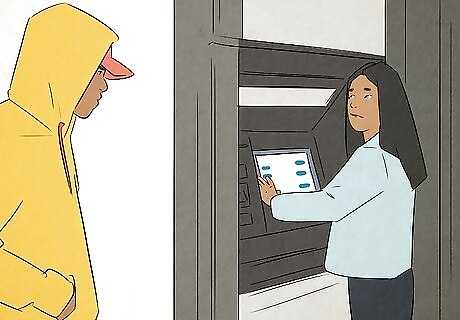

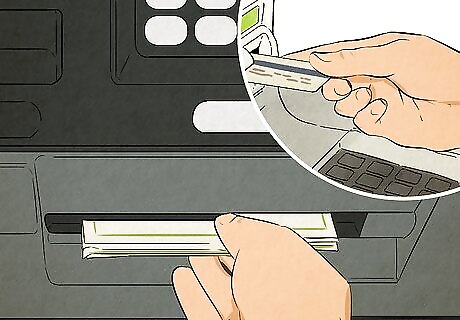

Insert your card into the ATM with the card’s chip facing forward. In most cases, your card will be a debit card. Debit cards are most frequently used in ATMs and are linked directly to your bank account—so the money you withdraw will come from that account. Some credit cards can also be used at ATMs, but the money comes from the card’s line of credit, so the ATM transaction will appear on your credit card bill. If you accidentally insert the card incorrectly, simply remove it, flip it in a different direction, and try again. The ATM may also have a diagram or animation showing the correct way to insert the card.

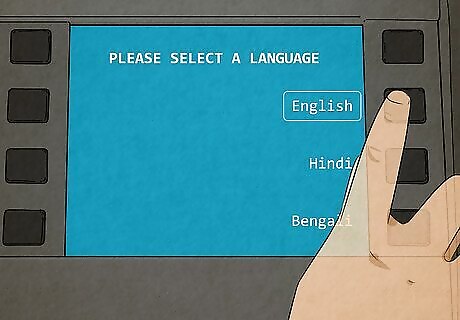

Select your language. Most ATMs will offer transactions in multiple languages, depending on where the ATM is located. Some ATMs will allow you to select your language before inserting your card, while others will ask you afterward.

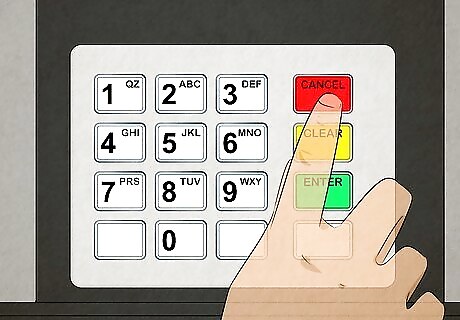

Enter your PIN when prompted. "PIN" stands for "personal identification number," and it's typically a four- to six-digit password people use to access their bank account. Enter your PIN when asked to by the machine, making sure to shield the pad with your hand so that nearby onlookers can't see it. The exact length of your PIN may vary depending on the financial institution associated with your ATM card. For security, never share your PIN with anyone.

Withdrawals, Deposits, & Other Transactions

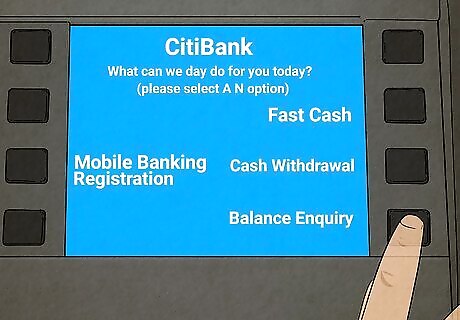

Withdraw cash from the ATM. Depending on the ATM, you’ll have the option for a “Fast Cash” withdrawal or a regular withdrawal. Fast Cash allows you to quickly select and withdraw a certain amount of cash from a list of common amounts—such as $40, $60, or $100. A regular withdrawal allows you to type an exact amount of cash to withdraw. If you use your debit card at an ATM affiliated with your bank, you can select which account you want the withdrawal to come from. For example, if you have a checking and a savings account, you can choose to withdraw money from your savings account instead of the checking account that’s normally linked to the debit card. Be careful not to exceed your withdrawal limits. Most ATMs and banks limit how much cash you can withdraw at a time, or per day. The exact limit depends on your bank and the ATM you’re using.

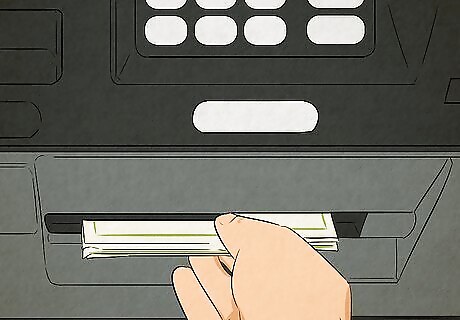

Deposit checks or cash into an ATM affiliated with your bank. After entering your PIN, you’ll see an option for making deposits. Select “Deposit Cash” or “Deposit Checks.” A small door will slide open near the card reader, revealing a slot where you can insert the cash or checks. Insert them, then let the machine count them. You’ll be asked to confirm the total amount for the deposit. If the amount shown is wrong, edit it to reflect the correct amount. Once the correct amount is shown, hit confirm to complete the deposit. If you have multiple accounts, you’ll be given the option to select the account where the money will be deposited. Your deposit may not be immediately available, or only a portion of it may be available at first. It may take a few days before the full amount is made available. Most ATMs don’t allow you to deposit checks and cash at the same time. If you want to deposit both cash and checks, you’ll need to do two separate deposits. You cannot make deposits if the ATM that is not affiliated with your bank.

Check your account balance using an ATM affiliated with your bank. After entering your PIN, you’ll see an option for checking your account balance. Your balance is the amount of money available in your account. This balance may be displayed on the screen or printed on a receipt, depending on the ATM. If you have multiple accounts, you’ll be given the option to select which account balance you want to view. You may also be able to view all balances at once. In some cases, you can still check your account balance using an ATM that’s not affiliated with your bank. But you may be charged fees for doing so.

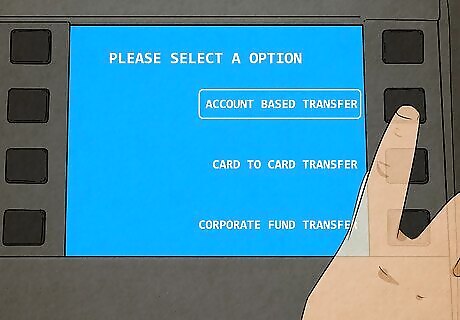

Transfer money between accounts using your bank’s ATM. If you have multiple accounts with your bank, you can transfer money from one account to another using one of your bank’s ATMs. After entering your PIN, choose the “transfer” option. Select which account you want to transfer from, followed by the account you want the money moved to. Specify the amount of money you want to transfer, then hit confirm to complete the transfer. Some banks allow you to pay bills using their ATMs. For example, if you have a credit card with your bank, you may be able to pay your credit card bill by transferring money from a bank account to the credit card balance. Check with your bank to confirm whether you can pay bills via an ATM. Depending on your bank, you may need to authorize ATM payments through an online portal first.

Press the red “X” button on the keypad to end your session. Depending on the ATM, you may also select an option onscreen such as “Cancel,” “End Session,” or “Return my card.” If you cancel your session in the middle of a transaction, the transaction will be canceled. If you have already completed a transaction, hitting the red “X” button will not undo the transaction. For example, if you have finished depositing a check, pressing “X” will not cause the machine to return the check.

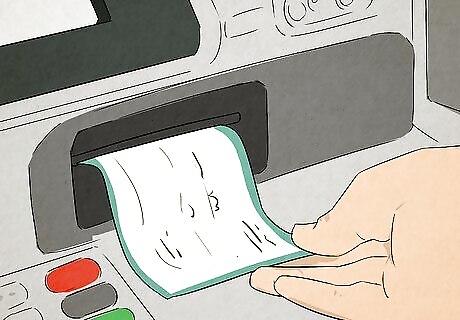

Take your card, cash, and receipt. It's easy to forget to take your money, card, or receipt when you're in a hurry. Be sure to grab these and put them away safely in your wallet or purse. Depending on the ATM, you may be asked if you want a printed receipt. Hit “Yes” to obtain a printed copy, or hit “No” if you prefer to review the transaction later via your bank’s website. If you forget your card, return to the ATM right away to retrieve it. If it’s lost, call your bank and cancel the card right away. Your bank will issue you a new card.

Comments

0 comment