views

Using Your Money

Pay off debts. Using your winnings to pay off old debts can be a great way to set up a more secure financial future for yourself. Eliminating debts also eliminates any further interest from accumulating on them. Using your winnings to pay off your debts can help you achieve financial freedom.

Invest your winnings. Saving your winnings will protect them, however, they will likely be depleted over time. Investing your winnings can allow them to grow, earning your even more income on your initial investment. Wise investments can even provide a livable income, allowing you to live off of your winnings permanently. Mutual funds are groups of stocks that are preselected by professionals and are generally a safe investment. You can also select and invest in your own hand-picked stocks. Although this can be more risky, it can also potentially bring higher returns. Learn more about investing https://www.wikihow.com/Start-Investing Consider consulting professional help when investing.

Purchase assets. Apart from investing, you can use your winnings to acquire assets. Assets are items, goods, or property that hold value over time and can solidify your winnings in these items. Acquiring these assets can be a great way to protect your winnings over time. Many assets will increase in value which in turn will increase your total wealth.

Consider donating. If you are able and willing to, donating your money to a worthwhile cause can be a great way to put your winnings to work for the good of others. You can find a charitable organization that you support or offer your winnings as funding for specific endeavors you would like to see realized. Some charities and donations can have tax benefits associated with them.

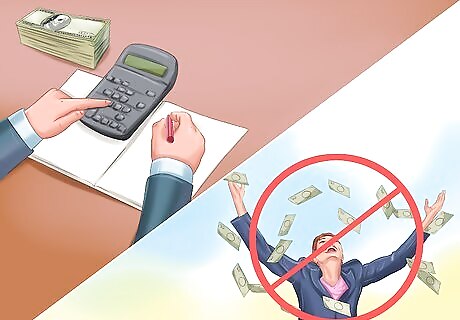

Budget your winnings. While it may be tempting to buy things you've always wanted and quit your job, you will still need to properly budget your new money. Without a good budgeting plan in place, your winnings can vanish as quickly as they arrived. Try to maintain the same standard of living as you did before you collected your winnings. Don't quit your job until you are sure you are able to live off of your winnings. Receiving your winnings in multiple payments over time can help you budget your new wealth.

Managing and Protecting Your Wealth

Understand the importance of managing your winnings. Income that can result from winning a lottery can be profoundly life changing, for better or for worse. In order to make your winnings work for you and sustain them over time, you will need to properly manage them. Don't splurge. You will need to budget and manage your winnings if you want them to last over time. Realize that you will likely become somewhat famous. Hiring a financial manager can give you a good excuse as to why you can't share all of your winnings.

Choose receiving a lump sum or multiple payments. You will likely have the choice of collecting your winnings in either one lump sum or in a series of smaller payments over time. Each choice will have its own benefits and disadvantageous so consider which will be best for you. A lump sum will be one large payment and can have an effect on your tax status. Payments over time can help you manage your winnings, spending only what is made available at the time of the payment.

Consider hiring a financial manager. Winning the lottery can be exhilarating; however, your new wealth will require proper management and professional knowledge to make the most of it. Hiring a financial manager can be a great way to make sure your wealth is maintained and will continue to support you.

Consult a tax advisor. Many states require that you pay taxes on any income generated from lottery winnings. Winning the jackpot in a lottery will likely change your tax bracket, resulting in different levels of payment and tax rules when it comes time to pay. Hiring a tax advisor can make the process easier for you and prevent you from making any errors when filing or paying. Filing your taxes wrong can result in an audit or legal action. Hire a tax advisor that works with clients who have similar amounts of wealth. Pennsylvania, Florida and Texas do not require a winner of the lottery to pay taxes on those winnings.

Comments

0 comment