views

Notifying Creditors

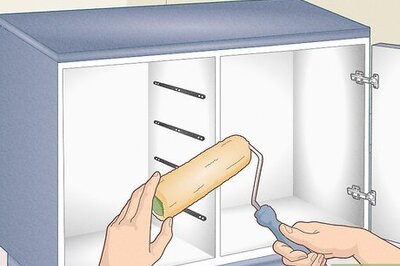

Locate possible creditors. State laws vary regarding the extent to which you must search out possible creditors. In California, for example, you are not required to make a search for possible creditors. Your only obligation is to notify creditors that are actually known to you. With that said, you cannot willfully ignore information that would reasonably give you notice to creditor claims (e.g., you cannot refuse to open an envelope that says "unpaid bills"). In a state like Florida, you must use "diligent efforts" to notify known or "reasonably ascertainable" creditors. In states like this, you will usually be required to make reasonable efforts to search out possible creditors. This might involve looking through the decedent's belongings and asking family members about possible debts.

Advertise the decedent's death. A lot of states require you to publish the decedent's death in multiple papers in the county where the estate is being probated. The act of advertising helps to notify possible creditors. For example, in Pennsylvania, you must advertise the decedent's death in two newspapers in the county where the decedent resided. In North Carolina, the advertisements must be published once a week for four consecutive weeks. In addition, the advertisement must state that creditors can make claims for a certain period of time.

Keep track of bills being sent to the decedent. Another way creditors can contact you is through the decedent's bills. As bills are sent to the decedent, they will usually get forwarded on to you. When you receive the decedent's bills, it will be considered notice and you will be responsible for paying them with resources from the estate. When you receive them, notify the creditor that the decedent has passed away and that the bills will be paid, if possible, out of the estate. Examples of bills you might receive include doctors' bills, credit card bills, and utility bills.

Complete various notice forms. For creditors you know about, you will be required to draft a formal notice that the decedent has passed away and that you are going through the probate process. Probate courts will generally have forms available for you as the representative of the decedent's estate. For example, in California, you can obtain the notice forms online from your court's website. The notice form will require you to provide the following information: Your information as the representative Information about the probate court Information about when potential creditor claims must be filed Information about the repercussions of filing a claim late

Mail the notices to creditors. After the notice has been filled out, you must serve each creditor with the notice and a blank claim form. You cannot mail the form yourself. You must have someone unrelated to the case send the forms. Once the server sends the notice, you will need them to fill out a proof of service form. The notice to creditors must usually be sent within 30 days of finding out about the creditor. You do not need to send notice to any creditor who has already filed a formal claim or whose bill you plan to treat as a demand for payment.

File evidence of the notifications with the court. When you receive all the proof of service forms from your server(s), you need to file them, along with any other paperwork you have, with the court. The court will look over your notifications and determine if you have followed procedures.

Responding to Creditor Claims

Determine if the claim is valid. Most creditors are required to respond to your notice form by filling out the blank claim form you sent and getting it back to you. Some creditors, for example secured creditors, are not required to file formal claims in order to enforce their rights. When you receive claims, review them as they come in. You want to look through the claim and determine if the debt is legitimate and whether it should be paid. You will need to review creditor claims quickly as you usually must respond to the creditor within 30 days of receiving the claim.

Complete an allowance or rejection form. Once you have reviewed the claim and decided whether to allow or reject it, you will need to fill out a form you will send the creditor in order to give them written notice of your decision. Forms should be available from your probate court. For example, in California, you can find blank allowance/rejection forms on your probate court's website. When you fill out the form, you will need the following information: The name of the creditor When the creditor's claim was filed The estimated value of the estate The amount of the claim The amount of the claim you either accept or reject

Mail the form to the creditor. Once you fill out the allowance/rejection form, attach a copy of the creditor's claim. You do not need to attach any other supporting documentation. Take the form and attachments and mail them to the creditor. You cannot send the forms yourself and you must have a server send them for you. Have the server fill out and give you a proof of service form once service is complete.

File the forms with the court. File the allowance/rejection forms, the proof of service forms, and the original creditor claims with the probate court. The court will review the claims and make the final determination as to whether the estate needs to approve or reject the claims.

Paying Creditors

Determine if the estate has sufficient funds to pay all creditors. Once the period for creditor claims is up (usually around one year), you will need to add up all of the allowed claims to determine how much the estate owes. Once you have a total, you will need to determine the value of all the assets in the estate. The value of assets will help you determine whether there are enough funds available to pay creditors. At this point in the probate process, it is likely that you will already have done an accounting of estate assets. If this is the case, you will simply need to update that asset list to reflect the current state of the estate. Common estate assets include cash, stocks, bank account funds, real property, personal property, and any other property that is not handled outside of the probate process.

Follow any directions in the will. The decedent's will might include directions regarding how creditors should be paid. In some circumstances, the decedent's will might state which assets should be preserved for distribution and which assets can be liquidated and used to pay debts. Unless the court says otherwise, you are required to follow the directions in the will as best as possible. For example, a will might state that the house should be preserved and not sold off to pay debts. In addition, it might state that bank account funds should be used to pay off debts. There are some circumstances in which you might not be able to follow the will's directions perfectly. If the directions do not allow for the full payment of debts, you will have to discuss your options with the court.

Make ongoing mortgage payments if possible. Some payments should be made even while you are going through the probate process. Mortgage payments are one of these payments you should continue to make using appropriate estate funds. Failing to pay the mortgage may result in losing the home to foreclosure. If the estate does not have the funds to make mortgage payments, talk with an attorney about how you can avoid foreclosure and protect the decedent's equity in the home.

Pay all creditors if the estate is solvent. An estate is solvent if there is enough money available to pay all the estate's debts. If the estate is solvent, you can pay creditors in whatever order you want. Commonly, representatives of solvent estates will pay debts as they come forward. With a solvent estate, you can even pay creditors who have not filed claims. However, you must be sure the claim is valid and that the estate has enough money to pay everyone else. If you pay a creditor out of order and it turns out the estate does not have enough assets to cover other, more senior debts, you might be personally responsible for the debts.

Pay creditors in the order prescribed by law if the estate is insolvent. An estate is insolvent if its debts are greater than the value of all its assets. When this happens, state statutes determine the order in which the debts must be paid. When you are going down the prescribed order, you must pay all creditors in each category before you move on to the next category. If the estate does not have enough assets to satisfy an entire category of debts, those debts must be paid on a pro rata basis with the remaining estate funds (i.e., all debts in any one category have equal precedent). For example, in Virginia, debts are paid in the following order: Costs and expenses of estate administration Certain family allowances (i.e., a statutory amount each family member will get from the estate) $4,000 worth of funeral costs Debts and taxes having federal priority Certain medical expenses not exceeding certain statutory amounts Debts and taxes owed to the state Debts due because the decedent was acting as a fiduciary Debts due to municipalities (i.e., cities, towns) All other debts (e.g., credit card debt)

Be aware of a creditor's ability to collect outside of the probate process. In most cases, if the decedent's estate cannot pay every creditor, the debts simply go unpaid. However, in some circumstances, creditors can reach assets that are not a part of probate proceedings. Creditors may be able to reach non-probate assets when: A beneficiary co-signs on the decedent's debt The decedent lives in a community property state (e.g., California) A state statute requires the debt to be paid by a spouse or other family member You are responsible for administering the estate and you do not do so properly

Comments

0 comment