views

Obtaining a Money Order

Decide on the amount of the money order. Many establishments will ask you to pay for the money order in cash. In some cases you will be able to pay with a credit or debit card.

Go to your bank. If you have a bank account, the easiest way to obtain a money order is to go to the teller and ask for one. Some banks may charge a small fee, but many offer money orders for free. Some banks offer cashier's checks, which are similar to money orders. Make sure the recipient will accept a cashier's check before buying one instead of a money order. Banks offer the benefit of keeping a record of your money order purchase, which could come in handy in the event that the money order gets lost.

Try local businesses. Drugstores, grocery stores, and places like Walmart offer money orders for a fee. Visit a few different places and choose the one with the lowest fee. Some establishments have a limit on the amount of the money order. If there is a cap, simply purchase more than one money order until you have the total amount you need. This is a good option if you need to transfer the money and there's no bank open or nearby.

Try the post office. Money orders issued by the United States Postal Service are usually replaceable if they are lost, stolen or damaged. The following benefits also apply to money orders purchased from the USPS: They can be purchased with debit cards. They are cashable in 29 other countries.

Consider purchasing a money order online. If you'd rather not purchase a money order in person, an online vendor might be a convenient choice. However, online companies usually charge steeper fees than local establishments. The leading online money order company is Payko, which caps daily money order purchases at just $200.

Try a money-oriented establishment. Western Union, credit unions, and other places that handle money usually issue money orders.

Filling Out the Money Order

Check to be sure the amount is correct. The establishment that issued your money order will have printed the amount on the money order slip. Double check to make sure it's right before you end the transaction.

Decide where to fill out the money order. You may want to fill out the money order on the spot, rather than carrying it to another location. If the money order lands in someone else's hands before it is filled out, that person could fill in their own name and cash it. If you do carry the blank money order to another location, keep it in a safe place on your person. When you get home, put it in a place where it won't get lost.

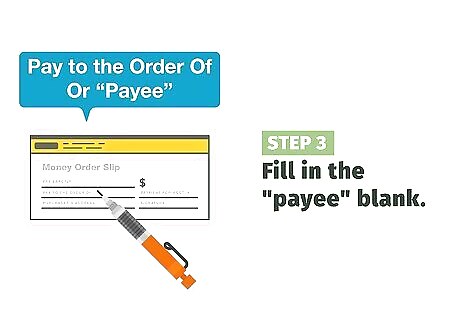

Fill in the "payee" blank. The first blank to fill in will say "Pay to the Order of" or "Payee." This is where you write the name of the person or company to whom you are giving the money order. Use black or blue non-eraseable ink to fill out the money order.

Fill in your personal information. Some money orders will have a space for you to fill in your name and address or other information. If you wish to fill this out, do so in blue or black ink.

Fill in transaction information. You may want to add details about the nature of the transaction, such as the name of the item you are paying for.

Sign the money order. If there's a space for you to sign the money order, you may do so, although it can still be cashed without your signature.

Paying With a Money Order

First make a copy. Since money orders are often used to pay people you may not know well, it's good to keep a personal record of the money order in case a problem arises. Make a copy of the money order and file it with your financial records. Keep it with the receipt that came with your money order.

Hand it over in person. The best way to pay with a money order is to give it directly to the recipient. This eliminates the chance that it will get lost or tampered with by a third party.

Mail it in a business envelope. If you're mailing a money order, make sure it's in a security envelope, rather than a letter envelope. Packaging it discreetly will prevent someone else from getting curious and attempting to tamper with the money order.

Comments

0 comment