views

Correcting a Bad Rental History

Purchase a rental history report for yourself. Some credit reporting agencies, such as Experian, also have divisions that produce reports on your rental history. By learning exactly what is on your rental history, you can see the information that property managers see and start taking steps to fix it. You can purchase a copy of your own rental report from a reporting company such as Experian, or you can purchase one from a third-party company.

Examine the report for incorrect information. Accidents can happen, and the report might reflect incorrect data related to your rental history. Your rental history falls under the umbrella of the Fair Credit Reporting Act (FCRA). According to this law, reporting agencies must correct or remove any information that is incomplete, incorrect, or unverifiable. If any information on your report falls into this category, contact the reporting agency. They must usually remove or correct the information from your report within thirty days. This also applies to credit reports in case you’re having trouble renting due to incorrect information bringing down your credit score. If the reporting agency claims to verify the information as correct, they do not need to remove it. Build a case if possible. Contact the owner, property manager, or landlord who oversaw your lease, and see if he or she will attest to the falsity of the information as it appears on the rental history report.

Try to fix negative aspects of the report that are true. Just because a negative portion of your rental history might be true, you still aren’t necessarily stuck with it. If, for example, you never paid a late fee on your last month of rent in a previous location, this information can end up on your rental history, but you can still contact the landlord or the community and try to fix it. Check with the landlord to see if you can still pay the fee (or whatever the source of the negative reporting). Get your payment in writing and submit it to the reporting company to have the instance of outstanding debt removed from your rental record. This can also work when trying to fix your more general credit report. If the landlord for the home or apartment you wish to rent wishes to contact your previous landlords rather than rely on a rental history reporting agency, this step is even more important. contact the previous landlord, apologize for the negative renting behavior, and offer to pay any money owed. The landlord may agree to update the reference he or she will give you for amending how you previously left things.

Petition to have old evictions removed. You can petition to have a previous eviction removed from your rental history by the reporting company if you’ve since repaid the landlord or community. Look into an eviction expungement in your county. By proving that you’ve since paid the debt or that the eviction was unfairly brought against you, you stand a good chance of having the request granted. The reporting company will then be required to remove the information via the FCRA.

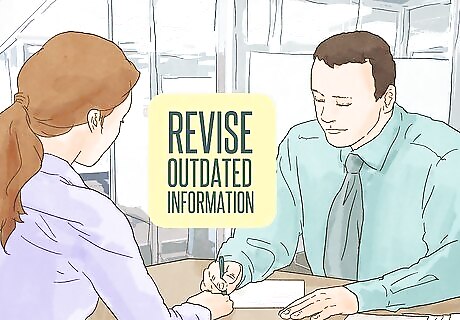

Have outdated information removed. Also under the FCRA, reporting agencies must remove bankruptcies ten or more years old, as well as most other negative reporting that is seven or more years old. If old information has brought down your rental history, then you can request to have it removed under the FCRA.

Convince beneficial previous landlords to report for the programs. Only landlords and communities that participate in the rental reporting programs will appear on your rental history. This means that if the application for a future community uses a reported rental history instead of requesting references from previous landlords, they can end up with an incomplete picture. Contact previous landlords who will report positive rental history information about you, and encourage them to submit that information to a rental history reporting program. This step might not help remove bad information, but balancing it with positive information provides a better, more accurate representation. This can especially work in your favor if the beneficial information will be more recent and frequent than the negative aspects of the report.

Renting with a Bad Rental History

Include a cover letter with your application. You may not always be able to repair your entire rental history. However, you can take other steps to address the history with your prospective landlord. If your application for the home or apartment includes an authorization for the landlord to perform a credit or rental history check, then you already know what he or she is likely to encounter. If you have a bad credit or rental history, you can take responsibility for any blemishes on your records, explain the surrounding circumstances, and assure the landlord that you’ll always pay rent on time for the duration of your lease by including a cover letter. Do not blame others or wallow in self-pity in the cover letter. Keep the letter concise and factual, and point to concrete examples of where you’ve otherwise been a responsible renter.

Include references. Explaining the reasons behind your poor rental history can help, but showing the prospective landlord that other people trust you will go even further. Try to get letters of recommendation from your boss, a previous roommate, another recent landlord, etc. Submitting the letters of recommendation along with your cover letter on the application can also make an immediate first impression with the landlord regarding how organized you are and how serious you are about the rental.

Find a co-signer. Many landlords are willing to overlook a poor rental history if you can find a close friend or relative with good credit to co-sign the lease with you. A co-signer doesn’t actually live with you like a roommate but simply agrees to be held responsible as well if you damage the property or fail to pay your rent. Essentially a co-signer agrees to take over payments if you fail to make them or risks affecting his or her own credit. Don’t ever take advantage of someone who agrees to co-sign a lease for you. This is also a good option for a first-time renter whose problem is a lack of a rental history as opposed to a bad one.

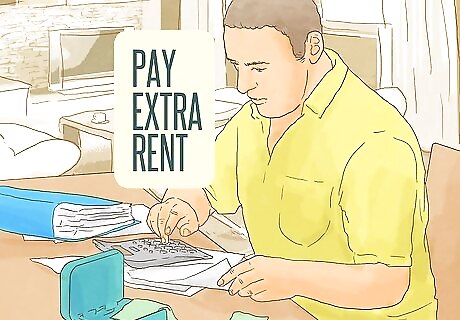

Offer to pay in advance or a larger security deposit. At the end of the day, a landlord simply wants to receive your rent on time. Offering to pay two or three months of rent in advance (or allowing the landlord to retain a larger security deposit) can help reassure the landlord that you’re serious about the renting responsibility.

Offer to pay more in rent. Most people may not have two or three months of rent to pay in advance. However, you can similarly offer to pay a little more on your monthly rent. Even offering to pay an additional $25 each month equates to an extra $300 for the landlord over a twelve-month lease.

Provide proof of employment. Showing the landlord proof of employment and pay stubs to verify your income might help convince him or her that you will be a reliable renter. The aforementioned letter of recommendation from your manager or supervisor is beneficial here as well. Have him or her verify the length of your employment and your job responsibilities. Proving recent dependability in other aspects of your life can work in your favor.

Suggest using direct payments. If your problem has always been remembering to pay your rent more so than the availability of the funds, you can suggest a direct payment method with your prospective landlord. This system would automatically pull your rent amount from your checking account each month without requiring any work from you—aside from assuring enough money stays in the account to cover your rent.

Find a roommate. If all else fails and you still can’t qualify for a place on your own, then try upgrading to a larger rental and find a roommate. Sharing a kitchen and living room isn’t always ideal, but a landlord will find a roommate with a solid rental and credit history reassuring when it comes to approving your application.

Comments

0 comment