views

X

Trustworthy Source

Official UK government website

Official website for the public sector of the UK government

Go to source

Paying a CCJ

Read the CCJ carefully. The CCJ you get in the mail will state how much you owe, the deadline to pay, and who to pay. It may also specify that the judgment must be paid in full, or that you can pay in installments. Check your own records to make sure you owe the amount listed on the CCJ. Sometimes the name and address listed will be the creditor's solicitor, rather than the creditor themselves. Call the court to find out who the creditor is if they aren't listed. If you responded to the initial claim and made an offer, the amount on the CCJ may be the offer you made. If the creditor rejected your offer, it will be the amount the judge determined you owe. If the total amount must be paid in full immediately, the amount owed on the CCJ will be followed by the word "forthwith."

Pay the judgment in full if you can. When you get the CCJ, it will state the total amount that you owe the creditor, along with the name and address for you to submit your payment. By paying it in full, you don't have to worry about it anymore. Send a check or money order through the mail, or contact the creditor and arrange a bank transfer. Retain receipt of the payment for your records so you can prove the payment was made. If you pay in full within a month of the date the CCJ was issued, it will be better for your credit. Otherwise, record of the judgment will stay in your credit file for 6 years.

Pay in installments. Your CCJ may provide a schedule of installments for you to pay. You can also work out an installment arrangement with your creditor. Send a check or money order to the creditor for each installment, or set up a standing order to have the money automatically withdrawn from your bank account. If you decide to mail in payments yourself, make sure you make each payment on time. If you start falling behind in your installment payments, the creditor may take you back to court. If that happens, you may be on the hook for extra costs.

Changing the Payment Terms

Draft a written budget. If you want the judge to lower the amount of your installment payments because you can't afford them, you have to be able to show the judge what you are able to pay. Create a monthly budget that includes your income and all of your bills. Make a list of all of your creditors and the amounts you owe them. This will help the judge determine how much you're able to pay. Debt charities, such as StepChange (www.stepchange.org), have budgeting tools that can help you.

Write a letter requesting redetermination if possible. If you responded to the original claim but your offer of payment was rejected, ask the judge to redetermine the payments and lower the installments if they are more than you can afford. If you're eligible to apply for a redetermination, your CCJ will say "judgment after determination." Your request for redetermination must be received by the court within 16 days of the date the CCJ was issued. In your letter, state that you're asking for the judgment to be redetermined under Rule 14.13 of the Civil Procedure Rules. Explain that you're in financial difficulty, and attach a copy of your budget and list of creditors. Debt charities have templates you can use to write your letter. For example, there's one available at https://moneyaware.co.uk/wp-content/uploads/redetermination.pdf.

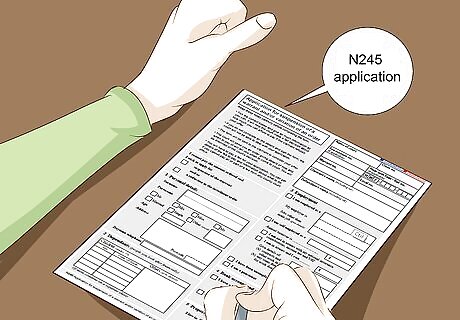

Fill out the N245 application form to vary the terms. Provide details about the CCJ and the payment terms you want to vary, along with information about your income and spending. Let the judge know how much you can afford to pay in installments. Download the form and instructions for filling it out at https://www.gov.uk/government/publications/form-n244-application-notice. Choose whether you want a court hearing. A hearing isn't typically necessary. However, having a hearing is a good idea because it gives you the opportunity to explain your situation to the judge in person.

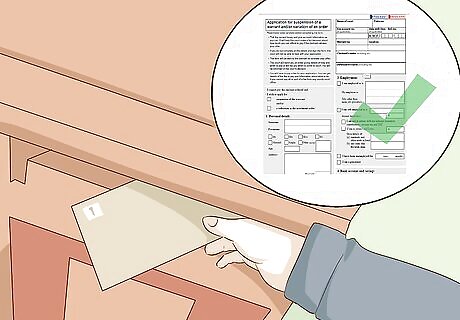

Send your application to the court. Once you've completed either an application for a variance or a request for redetermination, mail your paperwork to the court. For a variance, you must also include a £50 fee. Include your budget summary, list of creditors, and any other financial documents or information you want the judge to consider when making their decision. Make a copy of your paperwork for your own records before you mail it.

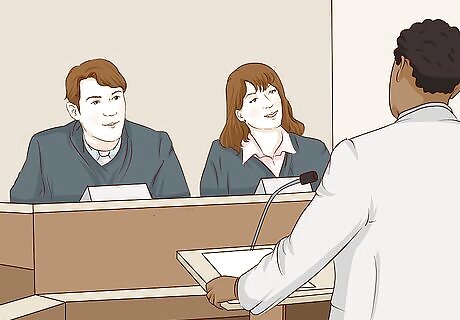

Attend a court hearing. You may have a live hearing before the judge for either a redetermination or a variance. At the hearing, you have the opportunity to discuss your situation with the judge and explain why you can't make the payments as ordered. After your paperwork is received, the court will notify you of the date and time of your hearing. If you can't appear on that date, call the court immediately to have it rescheduled.

Make the payments on the CCJ until the terms are changed. It may take several weeks for the court to decide whether to change your payment terms. Make every effort to make the installments as set forth on the CCJ until then. If you fail to make payments, the creditor could take you back to court, or take additional enforcement actions to get their money, such as having the payments taken directly out of your paychecks.

Cancelling a CCJ

Evaluate your reasons for having the CCJ set aside. Cancelling a CCJ may seem like the best possible outcome, but judges rarely agree to set these judgments aside. Typically a CCJ will be cancelled only if you never received notice of the claim, or you responded to the claim by the deadline but your creditor ignored your response and asked for a judgment anyway. For example, you may be able to get the judgment set aside if you recently moved and your notice of the claim was sent to your old address. Your chances of cancellation are better if you also have an argument against the amount the creditor claims. For example, in addition to never having received the notice, you made payments that weren't credited to your account.

Get advice and assistance from a debt charity. Because it's so difficult to get a CCJ cancelled, seek professional help before you attempt to do it on your own. Debt charities are nonprofit and will provide expert advice free of charge. The Hinckley and Bosworth Borough Council has a list of local and national debt charities available at https://www.hinckley-bosworth.gov.uk/info/200008/benefits_and_grants/886/list_of_organisations_which_can_help.

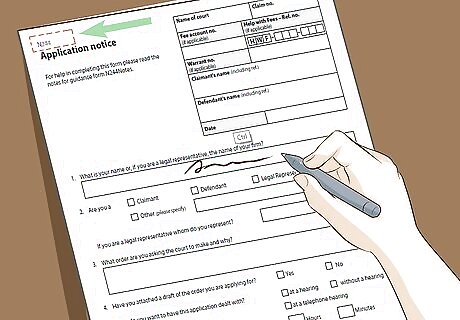

Fill out the application notice. Form N244 allows you to ask the judge to cancel the judgment against you. Read the instructions (the "notes for guidance") document carefully before you start filling out the form. Download the notice form and instructions at https://www.gov.uk/government/publications/form-n244-application-notice. If you're unsure how to fill out the form or what evidence to provide in support, contact a debt charity for assistance.

Send your notice to the court. Once you've completed your form, make a copy for your records and mail the original to the court along with the £255 fee. Pay the fee using a personal check or postal money order. If you have a low income or receive income support or assistance, you may be eligible to have your fee waived or reduced. Go to https://www.gov.uk/get-help-with-court-fees to apply for help with your court fees. Although it isn't legally required, you may want to contact your creditor and let them know that you're applying to have the judgment set aside, and give them your reasons why.

Go to your private hearing. A hearing is legally required if you've asked the judge to cancel or set aside the judgment. If you don't go to your hearing, your application will be denied and you'll have to pay the amount of the judgment according to the terms set out in the CCJ. You will receive a notice from the court in the mail with the date and time for your hearing. Arrive early and bring copies of all documents related to the CCJ and your finances, or anything you plan to introduce as evidence.

Work with the creditor to repay the debt. If the judge grants your application and cancels the CCJ, it simply puts you back in the position you were in before the CCJ was issued. If you have any additional disputes about the amount owed, you'll have to take this up with the creditor. If you set up a payment plan with the creditor, make sure you follow through with you. Otherwise, the creditor could take you back to court.

Comments

0 comment