views

Determining Adjusted Gross Income

Calculate wages earned. Look at your pay stub from your employer under "gross amount." This is before any other deductions are taken out. Do the same for your spouse's wages and add it to your amount if you are married and plan to file jointly. Multiply the monthly wages by 12 to get the annual amount. If you are paid weekly multiply the weekly gross amount by 52. Alternatively, multiply your monthly or weekly wages by the amount of time left in the year, then add that to your gross year-to-date income. Add any estimated variable income you will receive during the year, such as commissions and bonuses. Subtract income that qualifies as exclusions from tax, such as withholding for employer health insurance plans and pre-tax retirement plans, to arrive at the estimated amount your employer reports on a W-2 form.

Add any self-employment income for the year. If you and/or your spouse freelance or own a business you will add the net profit to your regular income. Start with the business income you made last year and subtract expenses from the past year to get the net profit. (This is the number you would have put on last year's taxes.) Then make adjustments for changes in income and expenses to get an estimated net profit for this year.

Estimate other investment income. This can include dividends from investments, interest income from bank accounts, net gains or losses from asset sales such as stocks, and net rental income or loss if you own rental property (subtract expenses from the rental income). Then add this amount to your total income. It is always a good idea to keep a log or special file of stock and bond purchases and sales. You will need the amount you originally paid to buy the stock to calculate gains or losses when you sell it. The capital losses may be limited. Rental losses may not be deductible in full. This is because they might be considered a passive loss. If you have rental losses, you may want to consult an accountant or tax consultant.

Add in taxable retirement income, if applicable. Estimate income from pensions and annuities, IRA and 401k distributions, and Social Security income using prior year taxable amounts. Refer to IRS Publication 17 for a more detailed coverage of gross income items and what is considered to be taxable for your particular situation. For example, distributions you receive from a Roth IRA are not taxable once you reach age 59½ and your account has been open for at least five years.

Subtract allowable deductions. There are several possible deductions you can subtract from your gross income. These include self-employed health insurance, one-half of self-employment tax, traditional IRA deductions, contributions to a Health Savings Account, or alimony paid. Subtracting your allowable deductions from your gross income results in your adjusted gross income (AGI).

Determine if you'll get a refund or need to pay taxes. Compare the federal income tax liability that you calculated to your total projected federal income tax withholding and estimated payments for the year. If the federal income tax liability you projected is greater than your withholding and payments, you may have a payment due when you file your tax return.

Calculating Deductions and Final Tax

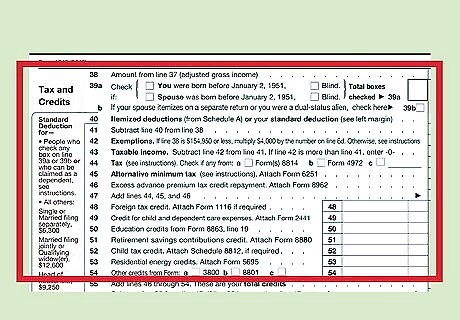

Determine your itemized deductions. Single people are allowed a $12,000 standard deduction and married couples filing jointly are allowed a $24,000 standard for 2018. If you can exceed these numbers you may be able to itemize (list and add up) your deductions and therefore pay less in taxes.

Calculate itemized deductions. If you can itemize, the categories allowed are detailed on Schedule A of Form 1040. They include medical and dental expenses, interest paid, gifts to charity, and state and local taxes. Take into account any limitations of these items noted in Schedule A. Your medical expenses must exceed 10% of your adjusted gross income for 2019 and future tax years. For 2017 and 2018, the threshold was reduced to 7.5%.

Subtract your deductions. Whether you are using the standard deduction or itemized deductions, subtract the total from your AGI. If you are using the standard deduction, refer to Form 1040-ES for the current year to determine the proper amount based on your filing status. Those who are age 65 or older or blind, or both, can add specified amounts to the standard deduction. If you are self-employed, you may qualify for the new Qualified Business Income Deduction. To learn more about if you qualify for this deduction and how to calculate it, see: https://www.irs.gov/newsroom/tax-cuts-and-jobs-act-provision-11011-section-199a-qualified-business-income-deduction-faqs. To calculate your taxable income, subtract either your standard deduction or itemized deductions as well as the Qualified Business Income Deduction (if applicable) from your adjusted gross income (AGI). This is what your federal income tax liability is based on.

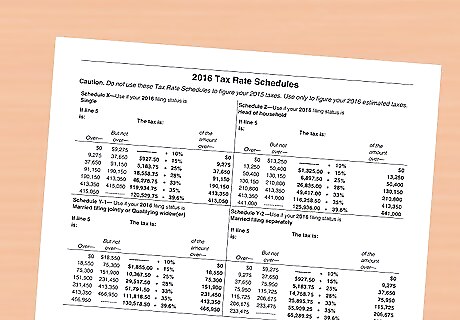

Determine your gross income tax for the current year. Refer to the tax rate schedules in IRS Form 1040-ES and use the schedule that applies to your situation. For example, use Schedule X for single filing status or Schedule Y-1 for married filing jointly. Certain types of income may qualify for a different tax rate, such as long term capital gains and depreciation recapture on real estate.

Subtract any tax credits that you qualify for. The most likely credits would be the child and dependent care or the child tax credit (both are subject to limitations). These credits and other possible allowable credits are covered in IRS Publication 17. Additions to the tax include self-employment tax based on self-employment income and penalty for early withdrawal of funds from IRA plans and other qualified retirement accounts. Add these amounts to your gross income tax and you will have your projected federal income tax for the year.

Comments

0 comment