views

Establishing a Framework for Investing

Set your goals. Spend some time thinking about why you are considering investing in stocks. Are you investing to build an emergency fund for the future, to buy a home, or pay for college expenses? Are you investing for retirement? It's a good idea to write out your motivation. Try quantify it in dollars, considering how much money you need for your goals. For example, purchasing a home might require a down-payment and closing costs of $40,000. Retirement might cost $1 million or more. Most people have more than one investment goal. Those goals often vary in priority and timing. For example, you may want to buy a house in three years, pay for a child’s education in fifteen years, and retire in thirty-five years. Documenting your investment goals will clarify your thinking and help you focus on the goal.

Determine your time frame. Your investment goals will determine the time during which your investments will remain in place. The longer investments can stay in place, the greater the probability of positive returns. If your goal is to have money to buy a house in three years, your time frame, or "investment horizon" is relatively short. If you are investing to fund your retirement 30 years from now, your investment horizon is much longer. The S&P 500 is a collection of 500 of the most widely held stocks. There were only four ten year periods between 1926 and 2011 where the S&P 500 as a whole produced a loss. For holding periods of fifteen years or more, there were no losses. If you bought and held these stocks over the long term, you would have made money. By contrast, holding the S&P 500 for just a single year would have produced a loss 24 times in the 85-year period between 1926 and 2014. Over a short period, stock are extremely volatile. As a consequence, investing for short time periods is riskier than investing for longer time periods. You can gain more if you've invested well. You can lose everything if you've invested poorly.

Understand your risk tolerance. All investments have risks because there is always a possibility that you will lose some of your money. Stocks are no different. How much risk you are willing to take is called your "risk tolerance." Before making any investment, ask yourself, "How much money am I willing to lose in the short-term in order to make more money over a long period of time?" In most cases, the more risk you take, the higher the potential return. But, there is also a greater likelihood of loss. One of the first rules of investing is to avoid losses when possible. Do not take on investment risk when it is unnecessary to reach your goals.

Calculate the investments needed to reach your goals. Use one of the many free investment or retirement calculators found on the internet. Calculate the rate of return that you must earn and the investment needed to reach your goals. For example, imagine you need $30,000 in three years, but can only invest $500 per month. You will need to earn a whopping 38.2% on your investment each of the three years to reach this goal. This means that you must accept an extraordinary amount of risk. Most people would consider such investments a bad decision. A better choice would be to extend your time horizon to four and one-half years. This would require a much more achievable and safe return rate 0f 4.8%. You could also increase your monthly investment from $500 to $775. This would let you reach your $30,000 goal with a realistic rate of return of 5.037%. Or, you could reduce your financial goal of $30,000 in 3 years to $19,621 in three years while investing the same $500 a month. To reach this goal, your return would only need to be 6% each year.

Choosing Investments

Understand different types of investments. The next task to select which investment is most appropriate for you. An important first step is to understand the different types of investments available. You can buy shares of specific companies. Buying shares of an individual company means that you are an owner of that company. As a result, your return will be like the owner of any other business. If the company sees increases in its sales, profits, and market share, the value of the company will normally increase. This is especially true over a long term. In the short term, the market price of the company depends on how people feel about the future of the company. Emotions, rumors, and perceptions will drive changes in value. The prices at which you buy and sell will determine whether you will make a profit. You can also invest in mutual funds. Mutual funds allow many people to invest together in many different stocks. The result is lower risk, but also lower return, especially in the short run. In recent years, Exchange Traded Funds (ETFs) have become popular. Many people call these “index funds”. These are like mutual funds. They are portfolios of stocks that typically aren't overseen by a manager. Most seek to copy the price movement of an index, such as the S&P 500, Vanguard Total Stock Market, or the iShares Russell 2000. Like individual stocks, ETFs are traded on the market. The value of an ETF can change over the course of a single day. Some ETFs track specific industries, commodities, bonds, or currencies. One advantage of index funds is that they are diverse investments. They reflect the various holdings that make up the index. Some index funds are also available for little or no commission. This makes them an affordable way to invest.

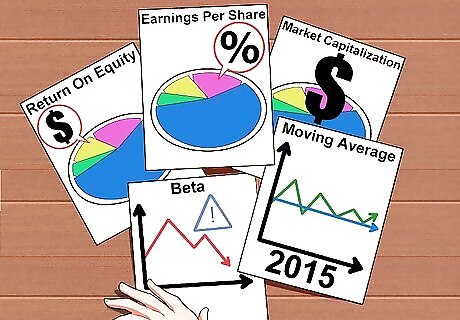

Understand key terms. Many people rely on financial news to understand the performance of different stocks or the market in general. To get the most out of these information sources, its important to understand several key terms. Earnings per share: the part of a company's profits that is paid out to stockholders. If you're hoping to earn dividends on your investment, this is important! Market capitalization ("market cap"): the total value of all a company's shares. It represents a company's overall value. Return on equity: the amount of income a company generates, relative to the amount invested by stockholders. This is useful for comparing firms in the same industry to determine which are most profitable. Beta: A measure of a stock's volatility, relative to the market as a whole. A useful measure for assessing risk. As a rule of thumb, beta numbers below 1 represent fairly low volatility. Numbers above 1 suggest higher volatility. Moving average: The average price per share of some company over a specific period of time. This can be useful in determining whether the current price of a stock is a good deal.

Pay attention to analysts. Analyzing a stock can be time-consuming and confusing, especially for first-timers. As such, you may want to use research from stock analysts. Usually, an analyst watches specific companies closely to assess its performance. There are free, reputable websites that provide synopses of analysts’ opinions on companies. Analysts often provide advice, in the form one or two word recommendations, for each specific stock. Some of these are quite obvious, such as "buy," "sell," or "hold." Others, such as "sector underperformer" are less intuitive. Different analysis firms use different words to make their recommendations. Financial websites often provide guides that explain the terms used by each firm.

Determine your investing strategy. Once you've gathered your information, it's time to think about your investment strategy. Different investors have different approaches, and there are several factors to consider. Diversity of investments. Diversification is the degree to which you spread your dollars over different investments. Investing all your money in a small number of companies can lead to a big payoff if those companies perform well. But, this approach also exposes you to a lot more risk. The more diverse your investments, the lower the risk. The more diverse your investments, the lower the risk. Compounding. This is the result of consistent re-investment of any earnings you receive. If you reinvest your earnings, you will then generate more earnings on those original dividends. Some companies have programs that allow you to do this automatically. Investing versus trading. Investing is a long-term strategy that aims at earning money based on long-term growth rates. Prices rise and fall, but hopefully rise in the long run. Trading is a more active process. It involves trying to pick stocks that will rise in price over the short term, and then quickly selling them. This "buy low, sell high" approach can result in big returns, but requires constant attention ad higher risk. Traders try to gauge people’s emotions about a company by interpreting historical price movements. Their goal is to buy while the stock price is rising and selling before the price begins to fall. Trading over short periods is high-risk and not for novice investors. Novice investors tend to trade more regularly by reacting to headline news or events, but investing is a long-term endeavor and isn't a reliable way to make a quick profit.

Buying Your First Stocks

Consider a full service broker. There are many ways you can make your stock purchases. Each comes with its own advantages and disadvantages. If you have little or no stock buying experience then you may want to start with a full service firm. Full service brokerage firms are more expensive, but they come with expert advice. For instance, your broker’s job is to guide you through the stock-buying process. He or she is there to answer questions. You may ask things like, “What stocks do you recommend based on my risk tolerance?” and “Do you have research reports on the stocks that I want to buy?” There are many full-service firms to choose from so you can ask around for a recommendation. For instance, a friend or family may have a broker whom they trust or have used for a long time. If not, then there are some larger, more reputable full service firms that you can explore. Some of these firms include Edward Jones, Merrill Lynch, Morgan Stanley, Raymond James, and UBS. Keep in mind that if you do go with a full service broker, you are usually going to be paying larger commissions. Commissions are fees that you pay any time you buy or sell a stock. For example, if you buy $5,000 worth of Disney stock, your broker might charge a $150.00 commission for executing the trade.

Consider a discount broker. If you don’t want to pay higher commissions for your stock market activity, you can use a discount or online brokerage firm. The disadvantage of a discount broker is that you won’t get the advice that you would from a full service brokerage firm. The advantage is that you will pay less and be able to buy your stocks online. Some reputable discount brokerage firms include Charles Schwab, TD Ameritrade, Interactive Brokers, and E*Trade.

Look into direct purchase options. These plans allow investors to buy stock directly from the company of their choice. They come in two varieties: direct investment plans (DIPs) and dividend reinvestment plans (DRIPs). These plans allow you to buy stock without a broker. Both are inexpensive and easy ways for investors to buy stock with smaller amounts of money at regular intervals. Not all companies have these options. For example, John enrolls in a DRIP plan that allows him to invest $50.00 in Coca-Cola common stock every two weeks. At the end of the year, he will have invested $1200 in the stock and paid no commissions. A disadvantage of investing through a DRIP or DIP can be the paperwork. If you invest in many companies, you'll have to complete forms and review the statements for each one. For instance, if you invest in 20 DRIP or DIP programs, then that’s 20 quarterly statements that you are going to receive. On the other hand, if you are investing $1000 every two weeks, that is a lot of commission saved.

Open an account. Regardless of which option you choose, your next step will be to open an account. You'll need to fill out some forms and possibly deposit money. The specifics will vary based on which option you choose for making your purchases. If you use a full service firm, pick a broker you are comfortable sharing your private financial information with. If possible, meet face to face so you can explain your needs and goals in specific details. The more information he has, the more likely he will solve your needs. If you use a discount brokerage firm, you will need to complete some online paperwork. You may need to mail in other forms that need physical signatures. You may also need to make a deposit depending upon the dollar value of your initial trade. If you invest through a DRIP or DIP, you will need to complete online and physical documents before buying your first stock. You will also need to deposit cash for any transactions before they occur.

Place an order. Once you've got an account set up, making first purchase should be quick and easy. Once again, though, the details will vary based on how you make your purchase. If you have chosen a full service firm, then you simply call your broker. He or she will buy the stock for you. Your account will already be open, so the broker will ask you for your account number. He or she will make sure that you are one of the account holders. Then the broker will confirm your order before he or she places it into the system. Listen carefully. Brokers are humans and can make mistakes when putting in an order. If you have chosen a discount firm, you will most likely place the trade online. When doing this make sure that you follow the directions carefully. Don’t confuse stock price with the amount of money you want to invest. For example, if you want to invest $5,000.00 in a stock trading at $45 a share then you DO NOT want to put an order in for 5,000 shares of stock. This will cost you $225,000.00 as opposed to $5,000.00. If you are using a DRIP or DIP, you can find the enrollment paperwork on the company’s website. Otherwise, you can call the company’s shareholder division and request that they send the paperwork to you.

Watch your investments. It is important to recognize that stocks and the stock market as a whole are volatile. Values move up and down, especially in the short term. If you see that one of your investments consistently performs poorly, it may be time to consider a change in your portfolio. Prices reflect human emotions. They will react to rumors, misinformation, expectations, and concerns, whether valid or not. There is little benefit to watching the price of your stock move during the day or week if you are investing for a time frame of a year or longer. Monitoring too closely encourages impulse decisions, which may exaggerate losses. Watch your stock performance over the long term. At the same time, recognize that something can go wrong with one of the companies that you own. For instance, if a company loses a major lawsuit or has to compete with a new entry into their market, prices may fall dramatically. In such cases, you need to consider selling.

Comments

0 comment