views

X

Research source

The emergency tax also may be applied to pensions. To avoid emergency tax, you must get a Tax Credit Certificate for your employer or pension provider. If you pay emergency tax, you can claim a refund from HM Revenue and Customs (HMRC) or Revenue in Ireland.

Starting Your First Job

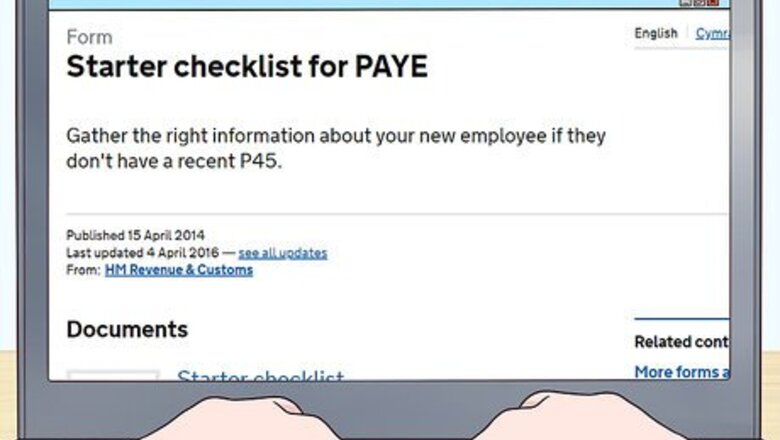

Complete your Starter Checklist. When you start work for the first time, the Starter Checklist, Form P46, is used to calculate the amount of taxes that will be withheld from your paychecks. Without this information, tax will be withheld at the emergency tax rate. You can download the Starter Checklist at https://www.gov.uk/government/publications/paye-starter-checklist. The Starter Checklist requires identifying information about you, including your national insurance number. You'll also provide information that may affect how much tax you have to pay, such as whether you're paying off a student loan.

Give your Starter Checklist to your employer. Once you've completed your checklist, make a copy for your own records and then give it to your employer. If you want to avoid emergency tax, make sure your employer has your Starter Checklist before your first paycheck is issued. If you don't provide enough information on your Starter Checklist for HMRC to determine the right amount of withholding, you may have to pay emergency tax temporarily. Once your code is determined, your rate will be adjusted so that you get back what you've overpaid.

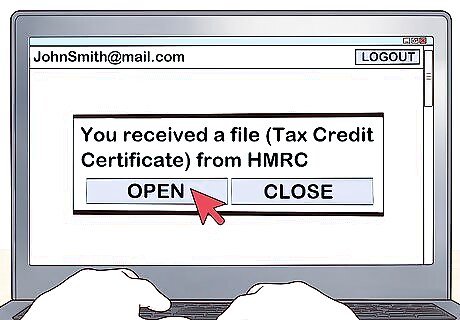

Register your new job with HMRC. Before you start your new job, log on to your online account and let HMRC know about it. You must register your first job so HMRC can issue a Tax Credit Certificate to your employer. If you don't register your job before you start working, you may have emergency taxes taken out of your paycheck temporarily. The rate will be changed once your employer receives the correct code from HMRC.

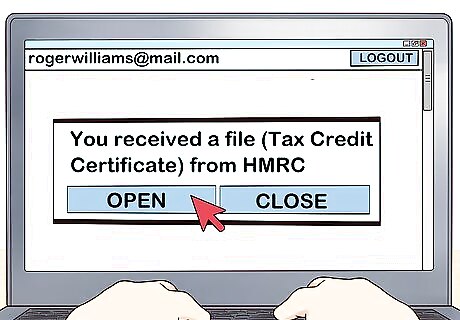

Get a Tax Credit Certificate (TCC) for your new job. Once your job is registered, HMRC will issue a TCC in the name of your employer. The TCC tells your employer what tax codes to use to withhold taxes from your paycheck. HMRC automatically sends the TCC to your employer, and also sends you a copy for your records. Check over it carefully to make sure all the information is correct.

Changing Jobs

Get a P45 from your previous employer. When you leave a job, your employer will give you a P45 document that summarizes your pay and the tax you've paid over the last calendar year up to your last day working for them. You'll only be issued one P45. Your employer is not allowed to make copies or issue a second P45. They can give you a letter that contains all the same information that was on the P45 if you lose it.

Register your new job or pension with HMRC. To avoid emergency tax, tell HMRC about your new job as soon as possible. You will need the name and tax registration number for your new employer or pension provider. You also must provide information about your employment, such as your start date, rate of pay, and frequency of pay. If you have an employee number provided by your employer, you should have that handy as well. You can add a job or pension through your online account, if you have one. Don't add your new job until your old job has ended. This can result in too little taxes being taken out of your paychecks.

Receive a Tax Credit Certificate (TCC). After you have successfully registered your new job or pension, HMRC will issue a TCC in the name of your new employer or pension provider. The TCC will be sent to your employer or pension provider, and you'll also receive a copy for your records. Your employer or pension provider may take out emergency tax if they don't receive a TCC for you in time.

Give your P45 to your new employer or pension provider. The P45 form has 4 parts. Your employer will send Part 1 to HMRC when they issue the form and give the rest to you. Parts 2 and 3 go to your new employer when you begin working. To avoid emergency tax, make sure your employer has your P45 as soon as possible after you start working, and well in advance of your first paycheck.

Use a Starter Checklist for second jobs. If you're still employed and decide to get a side job, you won't get a P45. Instead, you must complete and give your second employer a Starter Checklist like the one you used when you first started working. You must tell your second employer that you have another job, but you don't have to tell them how much you're making. Your second employer will send the information to HMRC and HMRC will adjust your tax code as necessary so you aren't paying too much. Your personal allowances typically only apply to one job. However, you can request that your personal allowances be split across two jobs if you want.

Claiming a Refund

Contact your pension provider. If you paid emergency taxes on withdrawals from a private pension, you may be able to get the excess amount refunded without claiming a refund through HMRC. Some pension providers automatically pay you back if too much income tax is withheld from your pension withdrawal.

Call HMRC to adjust your PAYE (Pay As You Earn) Code. If you believe you are paying too much in taxes, or if you've been paying emergency tax, HMRC can adjust your withholding so that you receive your refund automatically through your wages. The phone number for HMRC is 0300 200 3300. Operators are available from 8:00 a.m. to 8:00 p.m. Monday through Friday, Saturday from 8:00 a.m. to 4:00 p.m., and Sunday from 9:00 a.m. until 5:00 p.m. The line is usually less busy before 10:00 a.m.

Receive your tax calculation in the mail. HMRC sends out tax calculation in September. If you overpaid your taxes, you'll receive a P800. This document shows the calculation of how much you've overpaid. Compare the income and taxes on the P800 to your pay slips and other records. If there's a mistake or miscalculation, contact HMRC and provide the correct information. If you don't receive a P800 but believe you've overpaid your taxes, contact HMRC and tell them why you think you've paid too much in taxes. If they agree, they'll send you a check within 5 weeks.

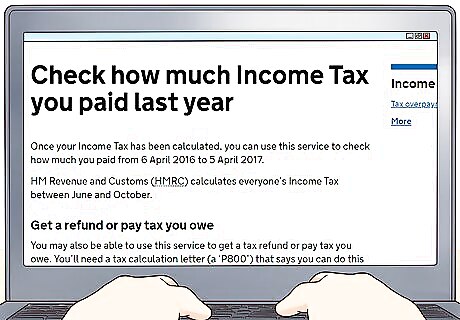

Claim your refund online. You may be able to claim your refund online through the HMRC website. If the amount on your P800 is accurate, go to the website and pull up your tax account. You can get started claiming your refund online by visiting https://www.gov.uk/check-income-tax-last-year and clicking the green button. Your refund will be in your UK bank account within 5 days after you claim it, depending on your bank's processing time.

Wait for a check if you can't claim your refund online. In some circumstances, HMRC will send you a check rather than allowing you to claim online. Your P800 will tell you whether you will be receiving a check. If your P800 says you'll be receiving a check, you can expect it within 14 days of the date on your P800. You'll also get a refund check if you are eligible to claim your refund online, but fail to do so. You have 45 days to claim your refund online before HMRC will mail out the check. If your P800 says you are eligible to claim your refund online, but you can't use the online service for whatever reason, you can call HMRC at 0300 200 3300 to get your check mailed to you sooner. Operators are available Monday through Friday from 8:00 a.m. to 8:00 p.m., Saturday from 8:00 a.m. until 4:00 p.m., and Sunday from 9:00 a.m. until 5:00 p.m.

Comments

0 comment